myITreturn Capital Gain Template features:

-

Import all data of top brokers into the excel template.

-

Current import allowed from - Zerodha, ICICI, HDFC, PAYTM, UPSTOX

-

Export to common format ready to be filed with myITreturn.com or Income-tax Department utility.

How to download the template?

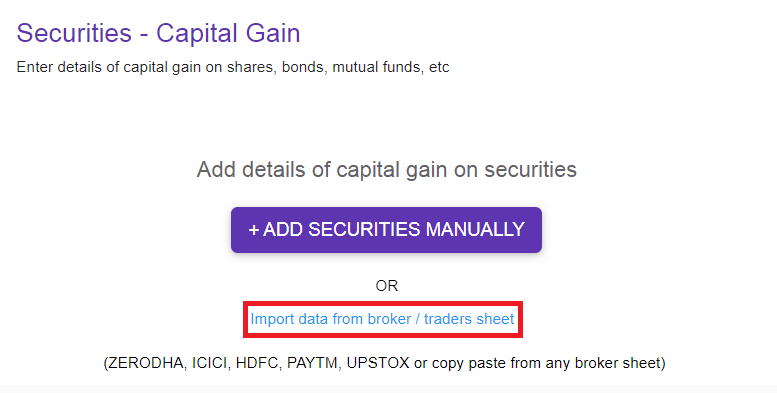

Post login to myITreturn.com while you are on the Capital Gain: Securities page, click the "Import data from broker/traders sheet" option.

How to Import details of broker file into this template?

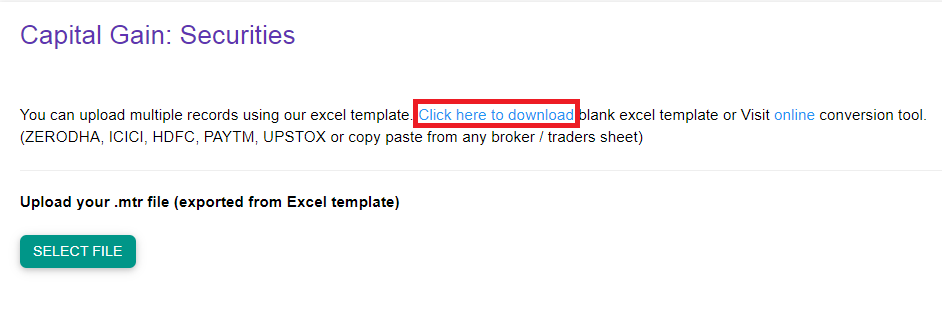

Download our excel template

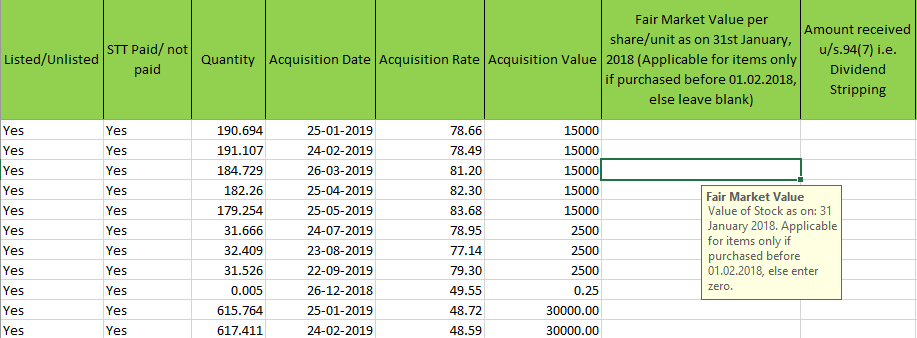

Enable macros and fill data manually in excel template

How to validate details and correct errors if any?

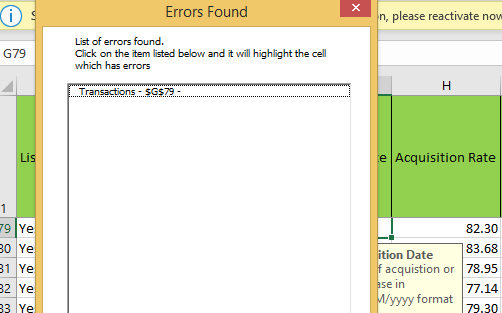

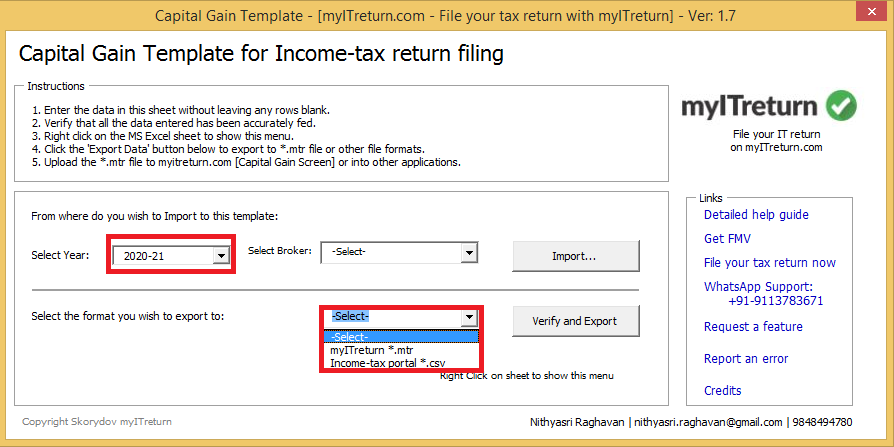

After filling data right click any where, a capital gain template window will pop up. Select year and select format you wish to export into. Then click verify and export, errors if any will pop up as shown below

How to export details in desired format?

Enable macros and right click anywhere and below window will pop up. Select year and select format you wish to export to and click verify and export.

How to upload details onto myITreturn.com?

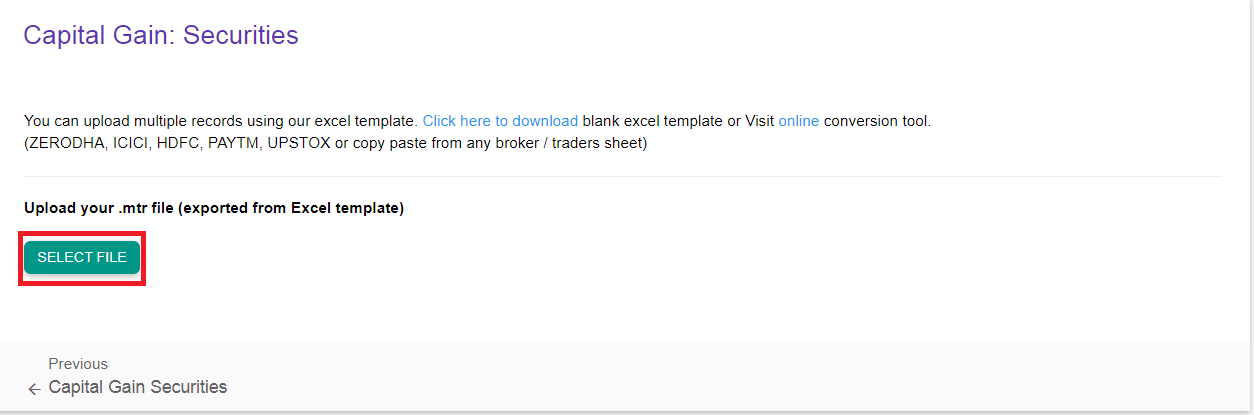

Come back on Capital Gain: Securities page and click on Select file and upload .mtr file.

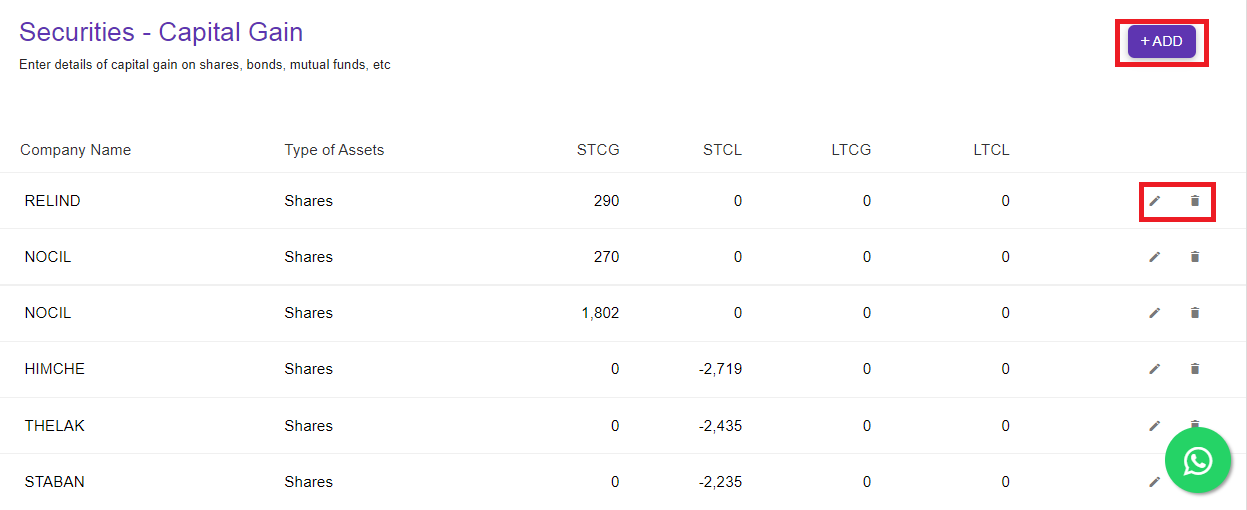

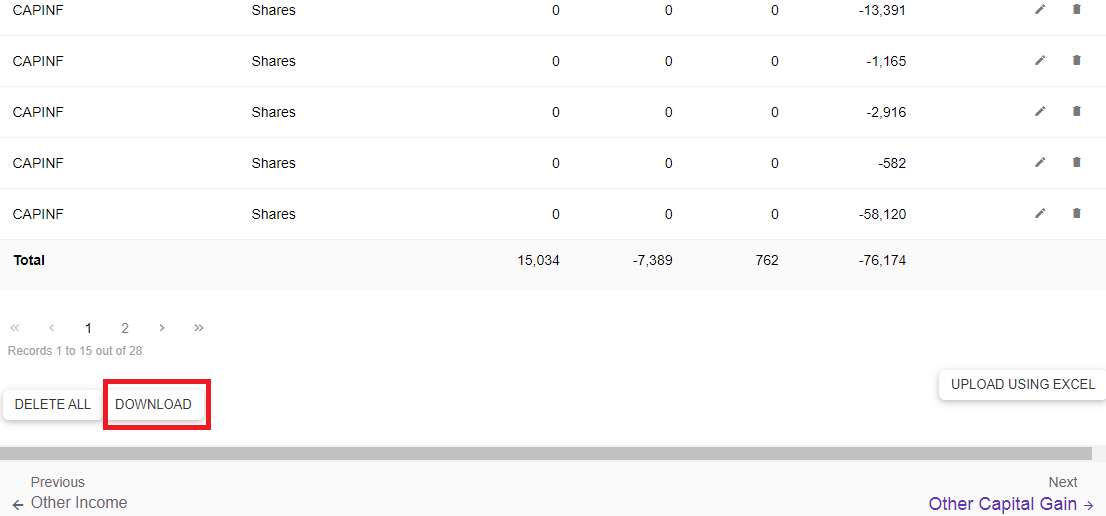

Your data is uploaded. You may add, edit or delete record

You can also download record

How to export details in Income-tax Department utility?

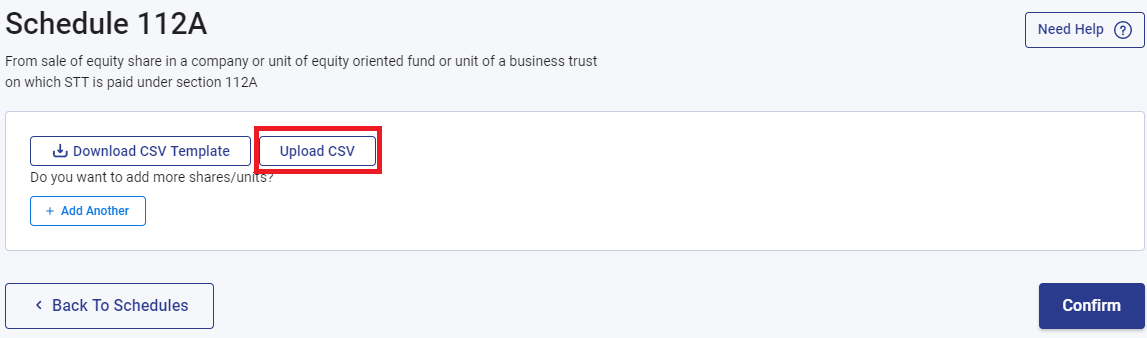

Download .csv and login to Income-tax portal. Post login while you are filling details of capital gains, click on Schedule 112A. In Schedule 112A click on upload csv

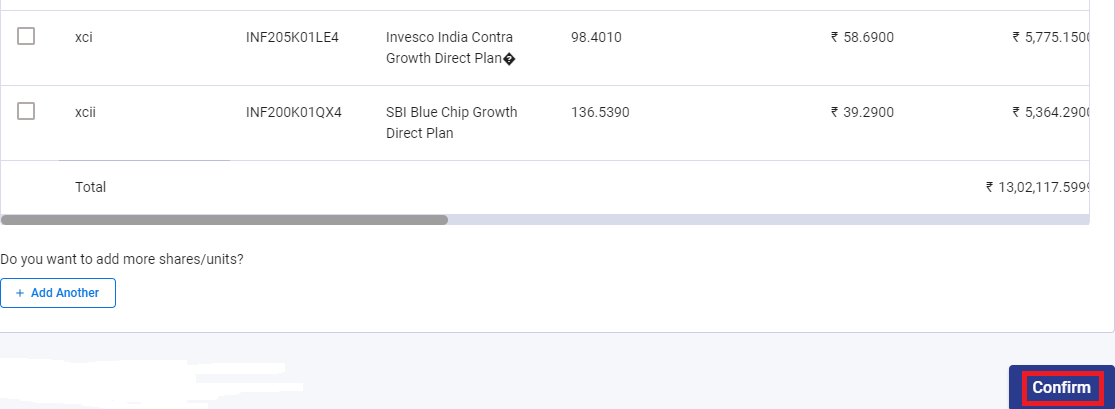

Your capital gains records will be uploaded. Click on confirm

Comments

1 comment

When Myitreturn will allow to file ITR-3?

Article is closed for comments.