Guide on Form 67

Given the wider scope of opportunities that other countries offer, it is not uncommon for individuals to go work in other countries and return to India. If you are such an individual, you might be in some dilemma. You would have paid taxes in the country where you were working temporarily and when you come back to India, you might be taxed again.

If you are a resident of India, the Indian tax laws require you to pay taxes on the global income. Meaning you would end up paying taxes on the same income twice. To avoid such instances, countries sign a mutual understanding in the form of DTAA. It stands for Double Tax Avoidance Agreement and its only focus is to ensure individuals do not end up paying taxes twice. And to enable this, the Foreign Tax Credit system comes into the picture.

Foreign Tax Credit

When two countries sign a DTAA, if you have paid taxes in one country, you can claim the same as tax credits in the country of your residence. Sections 90 and 91 of the Income Tax Act of India mention foreign tax credit.

Section 90 is aimed at handling scenarios where India has signed a DTAA with the other country. While Section 91 handles scenarios where India hasn’t signed any such agreements with another country. There were some confusions in the past regarding foreign tax credit. But with the introduction of Rule 128 and Form 67, most of them have been resolved.

Applicable from the 1st of April 2017, Rule 128 makes it clear that only residents can avail the tax credit. And this is only on the amount that they have paid as taxes in another country. And you can only claim for the credits if your income in India is being assessed on the same year as you are claiming the credits.

Form 67

If you want to avail foreign tax credit, Form 67 is something that you simply should not ignore or avoid. It must be submitted if you wish to get a tax credit refund. And if you fail to do so, availing foreign tax credit is next to impossible.

To ensure a smooth process, file your Form 67 on or before the standard due date for filing your tax returns. The 31st of July is the last date for the previous assessment year.

Documents Needed

You would need to attach supporting documents along with your Form 67 to ensure smooth processing. Usually, a certificate that states the type of income and the amount of taxes that you have paid should suffice. The certificate should be provided by the tax authority of the foreign government or the person who was responsible for handling your taxes such as your ex-employer.

How to Fill the form

The procedure to fill Form 67 was provided by the CBDT on the 9th of September 2019 via a vide notification. It can be summarized as follows:

- The form must be submitted before an individual file their tax returns.

- Taxpayers who plan to file their taxes electronically must submit their Form 67 online as well.

- Once a taxpayer logs in to the income tax portal, they can view the form.

- It is mandatory to submit the EVC or Electronic Verification Code or the Digital Signature Certificate (DSC).

Preparing Form 67

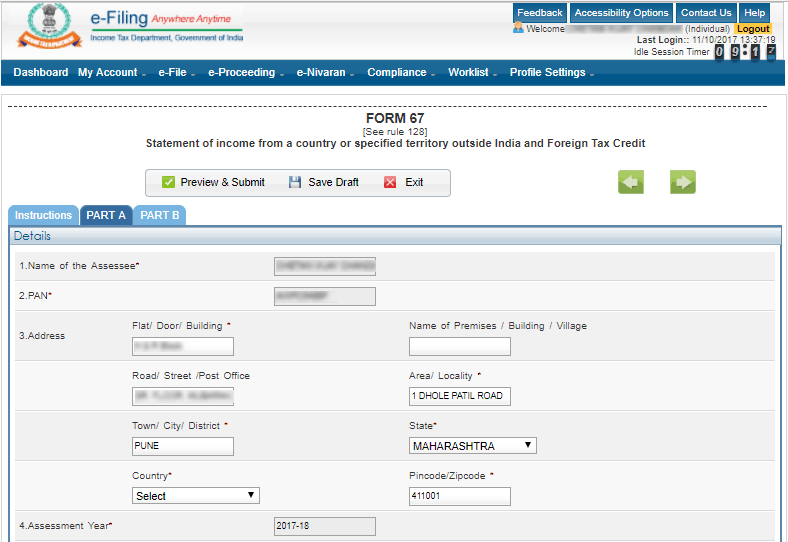

You would first need to login to the e-filing portal of the income tax department. From there, you can select Form 67 and the assessment year. The website will then present a form that you would need to fill. The first four sections in the form expect some basic information from you, such as name, address, Pan number and the assessment year.

The next section requires a lot of additional information. Here is a list of all the fields that you would have to fill in the form.

- Foreign Country

The name of the country/territory where you were working and have received income of some form. - Income Source

Your source of income in a foreign country. If you have multiple sources of income, you need to declare all of them. Whether it is salary or income from a rented property, it must be declared. - Total outside income

You need to mention the total income that you have received outside India or its territory. - Taxes paid

You need to specify the total amount of taxes that you have paid on foreign income. You need to mention the amount and the conversion rate of the currency as well. - Taxes paid in India

The tax that you have paid in India for such foreign income. - Tax credit under Section 90/90A

This section is applicable for income that you earn in countries that India has entered a DTAA with. You would need to mention the treaty, which mandates that the income is taxed. The total amount that is taxed as per DTAA - Total foreign tax credits

Once you will all the above details, the website will calculate the minimum credit amount.

FAQs

- Can anyone claim Foreign Tax Credit?

Only resident Indians can claim for the tax credits, as long as they have paid taxes in another country. - When should I file Form 67?

You should file Form 67 before filing your tax returns. - What is DTAA?

Countries get into DTAA or Double Tax Avoidance Agreement to ensure that taxpayers do not end up paying taxes on the same entity twice. If they have already paid taxes elsewhere, they can claim for tax credits. - What are the documents that I need to furnish to claim Foreign Tax Credit?

You would need to furnish documents to state the foreign income that needs taxation, a document to state the type of income and tax deducted, lastly a proof of the taxes that you have paid outside India.

- Where can I file Form 67 form?

The e-filing portal offered by the income tax department is where you can find and fill the form.

Comments

4 comments

Hi, Can you please tell me how to submit the documents, whether we have to submit online or through post.

I want to know which itr to be filled if a resident have income from salary in india and part of salary was received due to work in japan for 2 month. Whether to file itr 2 or itr 1?

You have to fill itr 2 and ofcourse you have to fill FSI schedule and FA schedule properly .I will advice you to take a guidance of any professional CA who have a good knowledge of DTAA

Hello there, Is it possible to fill Form 67 with ITR2 after the due date and still get the tax credit u/s 90?

Regards

Please sign in to leave a comment.