Whether it is your first year of filing taxes or you are a seasoned campaigner by now, the chances are high that you would have come across Form 16. It is quite obvious to have a few questions related to the same. Questions such as is it mandatory for your employer to provide you with Form 16, what is the use of it, how do I read the form 16, what to do if I have more than one form 16 etc.

The only time one might get a bit confused with the uploading and filing of your return process is if you change your organization. If you have changed companies, you are most likely to receive two or more Form 16s during a fiscal year. Multiple form 16 ITR filing might sound a bit complex, but it really isn’t.

Steps to upload multiple Form 16 in myITreturn

There are certain cases where a person can have more than one Form 16.

myITreturn has provided a solution for such cases. Now users can upload all the Form 16 and myITreturn will compile the details from all Form 16 for filing.

Here are the steps for uploading multiple Form 16 in myITreturn:

Step 1:

Visit myITreturn.com. There is a button “ Upload your Form-16 “, click on it. Please see the screen given below for reference.

Step 2:

After clicking on the button in Step 1, the below screen will appear. Upload your Form 16. It should be in pdf format.

Step 3:

The screen shown below will display once your Form 16 has been uploaded. The next step is to request you log into your myITreturn account. You will be required to sign up if you are a new user.

Step 4:

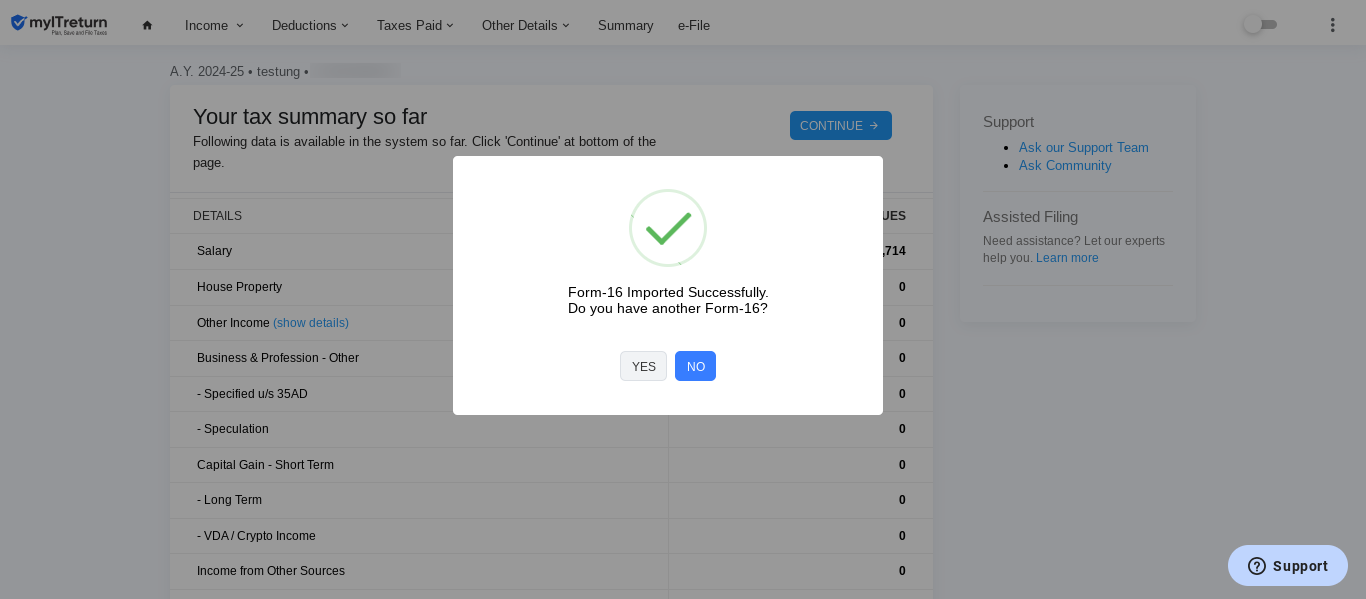

Once you log in, details of your uploaded Form 16 will be displayed under the head “Salary” . You will see the screen given below displaying your tax summary. In case you have another Form 16, click on ‘Yes’ button as shown in the screen given below.

Step 5:

After that, the below-given screen will appear. Click on the ‘Upload’ button and upload the second Form 16 in the same way as you uploaded your first Form 16.

Step 6:

Confirm details of Form 16 (Applicable in certain cases only)

Once Form 16 details are fetched, you will be shown the details for verification purpose as below:

Please verify imported figures with your Form 16. You should correct the details wherever necessary.

Step 7:

After you have entered all the details, you will be shown imported details for confirmation. Please confirm if the details are correct.

Step 8:

In case you are having more than two Form 16, You can always import the additional Form 16 from the option provided at various places.

Option 1: Member Dashboard

Option 2: Salary Income Screen

Please note that we have put our best efforts to import all details correctly. But you are advised to review all the details before proceeding to file the return.

Filing income tax returns is much easier with Form 16 around. Following the above steps will ensure that you are able to proceed with your return filing, with multiple Form 16 and without any hassles.

Once you upload your form 16 pdf to ITR, myITreturn will take care of populating all the required fields. Though we do our best, it is recommended that you review the return once thoroughly before filing your return. This will ensure that all information provided in your tax return is accurate and reduces any chances of it being held or returned for modification.

In the event that you have any queries, you can feel free to reach out to myITreturn and we will gladly help you out when it comes to filing tax returns with multiple Form 16s.

FAQs

-

Do I need to file my returns?

If you are a resident Indian and your income exceeds the minimum threshold of INR 2,50,000 for a fiscal year, it is recommended to file your returns.

-

Are there any benefits of filing returns?

Yes. There are actually quite a few benefits of filing your returns. A couple of examples include banks and financial institutions looking for your ITR to approve loans, it is helpful for visa applications as well.

-

Can I file my returns with two or more Form 16s?

Yes. You can file your tax return with multiple Form 16s. For further details, refer to the article above.

-

Can I get any assistance during my tax return filing?

If you have any questions or queries regarding tax return filing, myITreturn will be more than happy to assist you with the same.

Comments

0 comments

Please sign in to leave a comment.