In India, every taxpayer has the main motive of saving taxes. The taxpayers are always in a race to find out new measures for saving taxes. Some of the measures for tax saving are tax deductions given by the Government itself to encourage the citizens for paying taxes diligently.

Tax deductions mean those claims which are made by a taxpayer to reduce his taxable income arising from various sources of investments. Reducing the gross income which a person earns by different means will help in reducing the taxes to be paid. In simple terms, tax deductions help in reducing the total tax liability of a taxpayer. This is the sole reason for taxpayers searching for various means to reduce their gross income.

Benefits of Tax Deductions

The major benefits of tax deductions can be summarized below.

- As we already know, tax deductions will help in reducing a significant amount from the taxable income of a taxpayer and in turn save tax. When a taxpayer claims tax deductions, it decreases the portion of the taxpayer’s income that is subject to tax. By reducing your taxable income and saving taxes, you are opening up scopes for investment in other areas.

- By tax deduction, in the first place, your income which is subject to taxation will be reduced to the highest tax brackets. Then, you can easily claim tax deductions for expenses like medical expenses and tuition fees for your children.

Tax Exemptions and Tax Deductions

Both the terms appear to have a similar meaning for quite a large number of taxpayers. But, there lies some basic difference between these two terms. Tax exemptions include complete tax relief for a particular portion of your income. For example, if a taxpayer is making donations to relief funds or is contributing to charitable organizations then that portion is tax exempted.

In the case of tax deductions suppose you are spending or investing in certain avenues then your tax liabilities will decrease by a particular amount. For example, a taxpayer obtains tax deductions on the payment of insurance premiums.

All that a taxpayer earns in a particular year may be from a job, business, rent or investments; are subject to taxation. But, our Government provides us with a lot of options to save taxes by making investments into certain avenues which are beneficial. A number of such avenues and a guide to the deductions related to them have been mentioned in Sections 80C, 80D, 80G, etc. of the Income Tax Act. All these deductions are included under Chapter VI A of the Income Tax Rules, 1962.

Below is a tabular description of the deductions, limits with examples of those deductions mentioned in Sections 80C, 80D and many more.

| Deduction Section | Limit | Example |

| 80C | 1,50,000 | Life Insurance, Tuition Fees, Re-payment of Housing Loan |

| 80CCC | within 80C | Investment towards Pension schemes |

| 80CCD1 | 50,000 | Pension Schemes |

| 80CCD1B | 50,000 | |

| 80CCD2 | 50,000 | |

| 80D |

25,000 (senior citizen) 30,000 |

Medical Insurance for Self, Spouse |

| 80D |

25,000 (senior citizen) 30,000 |

Medical Insurance for Parents |

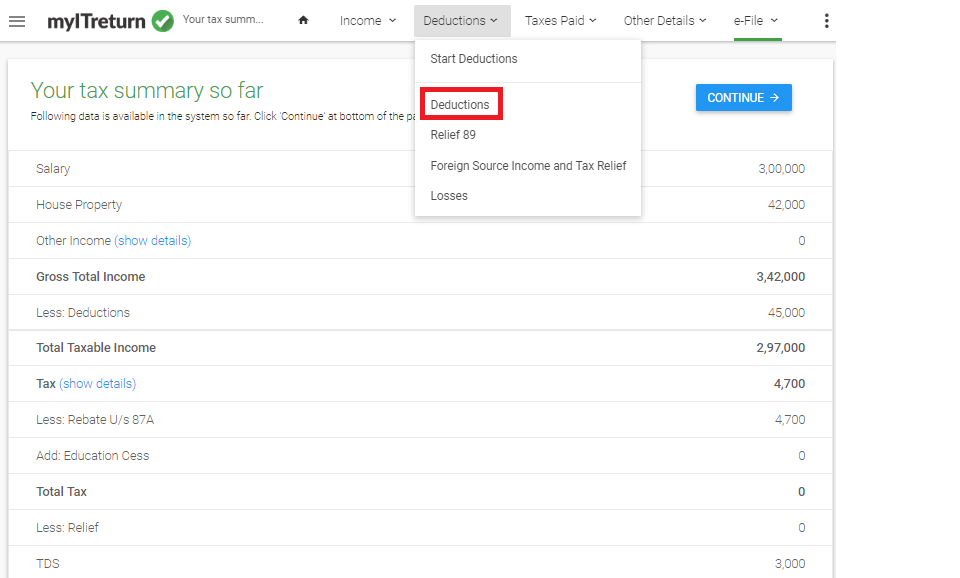

Enter details on deductions page:

Limit of Chapter VIA deductions

Let us have a complete study on some of the deductions and deduction limits of deductions covered in Chapter VIA.

Section 80C

Section 80C deals with the deductions that are available on investments. Under Section 80C, you are eligible to claim Rs. 1,50,000 from your total income which is taxable. This benefit is available for individual taxpayers and Hindu Undivided families. You have to specify this while filing for Income Tax returns and you will be able to obtain your extra money in your account.

There are a large number of tools or instruments in which investments can be made such as

- PPF Account

- National Savings Certificate

- Contribution to EPF

- Mutual Funds

- Tax Saving Fixed Deposits

Apart from these instruments, there are many other investment tools that help in the tax deduction claim. Amongst these, the most popular one is the PPF deduction. The contributions made to PPF account each year are eligible for a tax deduction and the limit for which is Rs.1.5 lakhs.

Section 80CCC

Section 80CCC of Chapter VIA is about the LIC deductions or those deductions that can be claimed on the premium paid for LIC or other insurance providers. According to this section, an individual can avail of a tax deduction for any amount which has been paid towards the annuity plan of LIC or any other insurance provider. This Annuity plan must be for the purpose of receiving a pension from a fund that has been mentioned in Section 10(23AAB). The pension that is received from the annuity or any amount which is received on the surrender of the annuity is taxable in nature.

Section 80CCD

This section deals with the deductions that can be availed on contributions made to Pension Account. According to Section 80CCD(1), the maximum deduction that can be availed is 10% of the salary if the taxpayer happens to be an employee or 20% of the gross total income if the taxpayer is a self-employed person or Rs.1.5 lakhs whichever tends to be less.

There has been an introduction of a new section i.e. Section 80CCD (1B) which allows an additional deduction of Rs.50, 000 if the taxpayer is depositing in his NPS account. In other words, Section 80CCD (1B) is about the Pension scheme deductions.

Furthermore, if you are an employer contributing towards an employee’s pension account; then you can obtain a tax deduction of up to 10%of your salary.

Section 80CCE

Section 80CCE is not a separate deduction, but it is to set a maximum limit on the deductions under Section 80C. According to Section 80CCE, the maximum amount of deduction that a taxpayer is eligible to claim under Sections 80C, 80CCC and 80CCD is limited to Rs.100, 000. This section will allow deductions to be made from the Gross total income of the taxpayer for certain contributions made towards pension schemes.

Section 80D

Section 80D states the deductions that can be claimed by a taxpayer for paying the health insurance premiums. An individual or an undivided Hindu Family can claim a tax deduction of Rs.25,000 on payment of health insurance premium for himself, his spouse and dependent children. Moreover, a tax deduction of up to Rs.25,000 can be availed by you if you are paying the medical insurance premium for your parents who are below the age of 60 years.

If your parents are above 60 years of age, then you can avail of a tax discount of up to Rs.50,000 on health insurance premiums. Furthermore, if both the taxpayer and his parents are above the age of 60 years; then under Section 80D, the permissible tax deduction can be up to Rs.1,00,000.

Section 80E

Under Section 80E, an individual is allowed to avail a tax deduction for the interest on study loans taken for higher education. This study loan can be taken for self, for the spouse, for children or for a student for whom you are the legal guardian.

The deductions under Section 80E are available for a maximum of 8 years or till the period of entire repayment of the interest whichever is earlier.

In addition to the deductions mentioned briefly, there are many other deductions that can also be claimed by a taxpayer like Section 80G which are meant for donations made towards social causes, Section 80U which is meant for a taxpayer suffering from physical disabilities, Section 80GGB, Section 80GGC, etc.

Hence, these provisions are made by the Government for making it easier for the citizens of the nation to save taxes. However, there are cases when people make dishonest utilization of these provisions and make claims even though they have not made any such investments. In those cases, if the Income-tax Department gets suspicious about these claims; then there can be inquiry along with other legal procedures as well. So, it is advisable to make optimum use of these provisions but in an honest and fair manner.

FAQs

- Can the benefits of Section 80C be claimed by a firm?

The benefits of Section 80C are meant for individual taxpayers and the Hindu Undivided Family. So, its benefits cannot be availed by a firm. - Is it possible for a company to claim deductions for donations made under Section 80G?

The benefits under Section 80G (donations made towards specific funds, institutions, etc. can be availed by any taxpayer. - Is there any maximum limit up to which a taxpayer can claim deductions under Section 80E?

There is no such maximum limit up to which a taxpayer can claim deductions under Section 80E.

Comments

0 comments

Please sign in to leave a comment.