Atal Pension Yojana

The government of India announced a new scheme called “Atal Pension Yojana (APY)”. The scheme is administered by the Pension Fund Regulatory and Development Authority (PFRDA) of India. This guaranteed pension scheme focuses on creating a retirement corpus for individuals from weaker sections for their old age. The individual who has contributed to Atal Pension Yojana will receive a fixed pension amount after 60 Years of age depending on the amount contributed and duration.

Who can join this scheme?

Any Indian citizen of age between 18 to 40 years can join this scheme by opening an APY account in the bank. Following are the requirements for opening APY account-

- A person should have a savings bank account. If he is not having an account, he is required to open his savings account before opting for the scheme.

- A person should have mobile number and he is required to provide it as contact details to the concerned bank.

- A person should also provide the details of his nominee for the APY account. One person can open only 1 APY account.

What are the benefits of Atal Pension Yojana?

- The APY will provide security to the citizens during their old age.

- The APY will encourage the habit of investment and saving among the lower middle and poor sections of the society.

- Contribution to APY will be eligible for tax benefit under section 80CCD(1) of the Income Tax Act.

- A fixed amount can be received by the subscriber every month after retirement (age of 60 years) till the death of the subscriber. After the death of the subscriber, his / her spouse will become eligible for the same amount until the death of the spouse. After the death of the subscriber and spouse, the nominee will receive the entire amount accrued by the account holder.

How much will be the contribution?

The amount of contribution will depend upon the joining age and the fixed pension required at retirement. As per this scheme, the contribution is directly debited from the savings bank account of an Investor and hence there is no need to deposit such contribution in cash or by cheque.

The further savings bank account should have sufficient balance at the start of every month so that contribution could be made automatically to APY Account. If the account is not having sufficient balance, the investor may get penalized.

What are penalty charges under APY?

If the contributor makes default in making a contribution to the scheme, then the penalty will be levied by the concerned bank as stipulated by the Government. The penalty is as follows:

|

Amount of Contribution |

Penalty per month |

|

Upto Rs. 100/- |

Re. 1/- |

|

Between Rs. 101/- to Rs. 500/- |

Rs. 2/- |

|

Between Rs. 501/- to Rs. 1,000/- |

Rs. 5/- |

|

Above Rs. 1,000/- |

Rs. 10/- |

What is co-contribution by Government?

The government will also co-contribute to this scheme for 5 years i.e. from the financial year 2015-16 to 2019-20.

Conditions for co-contribution by Government-

Co-contribution is available to investors

- Who has joined the scheme before 31st December 2015 and

- Who are not Income-tax payers and

- Who is not covered by any other social security scheme like provident fund, public provident fund, etc?

The amount of contribution shall be the actual contribution of investors or Rs. 1,000/- per annum, whichever is lower.

What is the tax treatment of this scheme?

As per the recent notification from the Department of Revenue, with effect from 19th February 2016, if a taxpayer invests any sum in Atal Pension Yojana, he can claim the benefit U/s. 80CCD of the Income Tax Act, 1961.

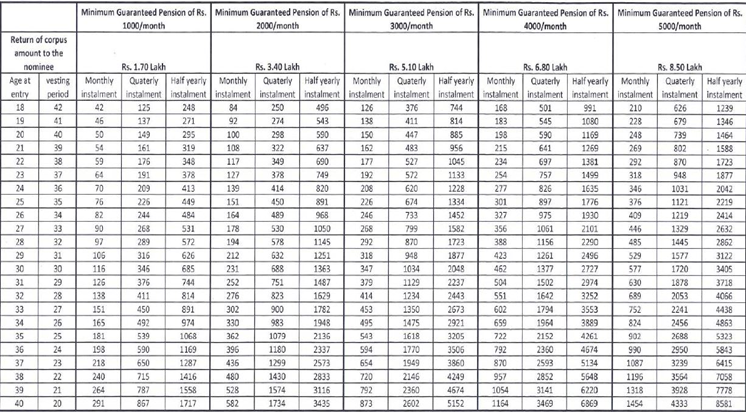

What is the amount of pension?

The scheme pays a guaranteed minimum pension starting from Rs. 1,000/- to Rs. 5,000/- per month to the investor or his nominee depending on the contribution after he attains the age of 60 years.

Whether nomination is mandatory while joining APY?

Yes, providing nomination details is mandatory. The Aadhar details of the nominee are also required to be provided.

Can the monthly contribution amount be changed by APY subscribers?

Yes, it can be increased or decreased depending upon the requirements of the subscriber once in a year during April.

How can the balance of APY be checked?

The APY subscribers will receive periodic statements of their accounts showing the account balance. Alternatively, the information can be obtained through SMS on the registered mobile number.

What will happen to APY account if the subscriber becomes an NRI?

Only Indian citizens are eligible to open the Atal Pension Yojana account. If the subscriber becomes an NRI, then his account will be closed and treated as a voluntary exit done before the age of 60. The contribution accrued will be given to the subscriber.

Table showing monthly, quarterly and half-yearly contributions for a different minimum guaranteed amount at different age entry and return of corpus amount to the nominee.

Comments

0 comments

Please sign in to leave a comment.