When it comes to filing taxes, taxpayers take the utmost care to ensure all the information is filled up properly along with necessary supporting documents. However, during filing of taxes or even during returns, there are chances of mix-ups. In a bid to file their tax returns before the 31st July deadline, taxpayers tend to make a few mistakes here and there.

Some commonly made mistakes include forgetting to report some sources of income or not claiming for certain deductions. Another common mistake taxpayer’s do is to provide incorrect information as far as bank details are concerned.

If you are one of those taxpayers who filed their returns on time, you need not worry since you have the time to revise your return. The tax laws undergo amendments frequently, such as the one introduced last year. The latest amendments make way to a higher standard deduction and changes in the tax slab. Such changes can also lead to taxpayers making errors.

Benefit of timely return filing

File your returns at the earliest. This is a phrase that you will come across more often than not and there are strong reasons for the same. It helps you avoid any last minute errors and unwanted corrections.

If there are any discrepancies or errors in your tax returns, you can revise the changes and file them back again. Section 139(5) allows taxpayers to revise their tax returns and submit if they see any error. You can file the revised returns any time before the next financial year. For example, returns for the financial year 2018-2019 can be filed any time before the 31st of March 2019. However, people who make false returns intentionally will be penalized under Section 271(1)(c).

But your return might not always be returned for a revision. However, if your tax return is sent back for revision, you have two options. Either agree with the error or defect and revise your return or provide a written response to the defect or error. This will ensure a smooth closure.

Knowing your income tax ward/circle might be helpful in such instances. You can reach out to your assessing officer for further clarification or details, should there be a need.

What is Income tax ward circle?

For the assessment year 2017-2018 about 5.44 crore taxpayers had filed for their tax returns. For an easier assessment, the income tax department has split the country into several income tax ward circle. The income tax department then assigns an AO or assessing officer to each of these wards. The motive behind all this is to make the returns both easier and issue free.

The task of an AO is to go through the returns and assess them. Should they find any discrepancy, they would send out a notification to the respective taxpayer who then can go ahead and make the relevant modifications or revise the return.

If you are interested to know your ITD ward circle, there are two simple methods to find out. In either case, you will have to visit the income tax e-filing website.

The first method requires you to login to the income tax e-filing website using your PAN number and registered phone number. An OTP or one-time password will be sent to your registered phone number and upon entering it, you can view your ward jurisdiction details.

The second method to find out income tax ward circle list is to login using your credentials for the website. For this method, you can find out income tax ward circle by PAN number. You would need to enter your PAN number, password and captcha. Then you can access the ward list by accessing profile settings -> My Profile -> Pan Details tab.

Income-tax department has assigned many Income-tax officers across the country to assess the various categories of taxpayers allotted to them.

Each category of taxpayers would fall under the Jurisdiction of the particular officer assigned for that area/category.

Steps to know your Income-tax ward/circle are as follows:

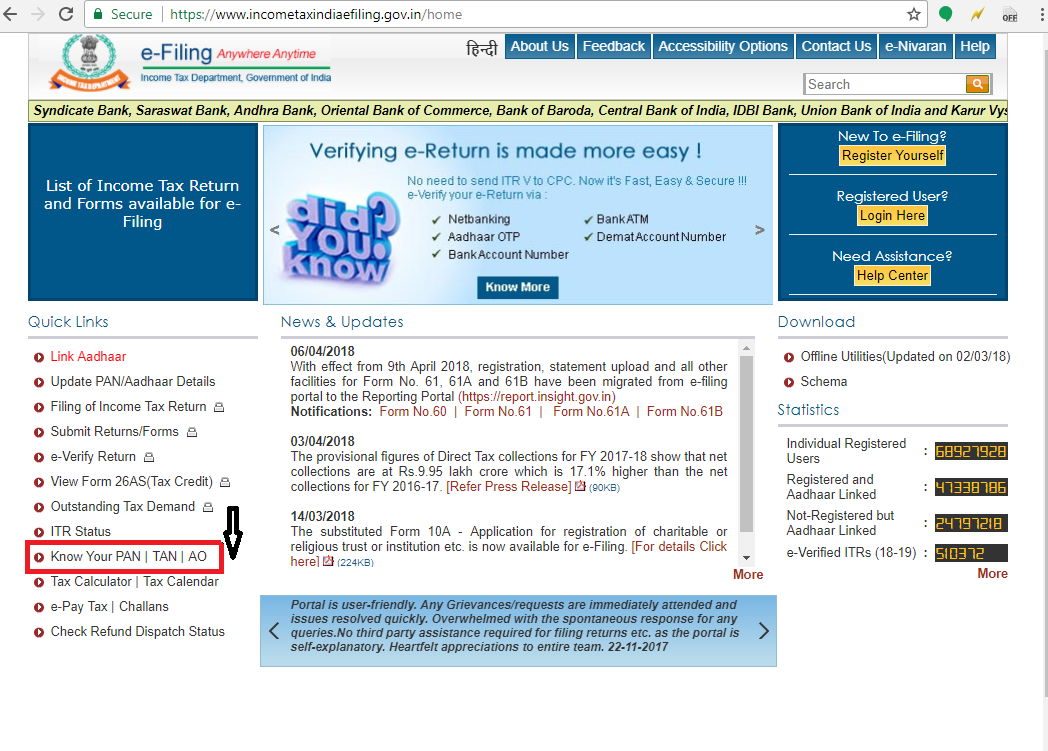

1. Click on “Know your Jurisdictional AO” on the homepage of directorate of Income-tax i.e. http://incometaxindiaefiling.gov.in/

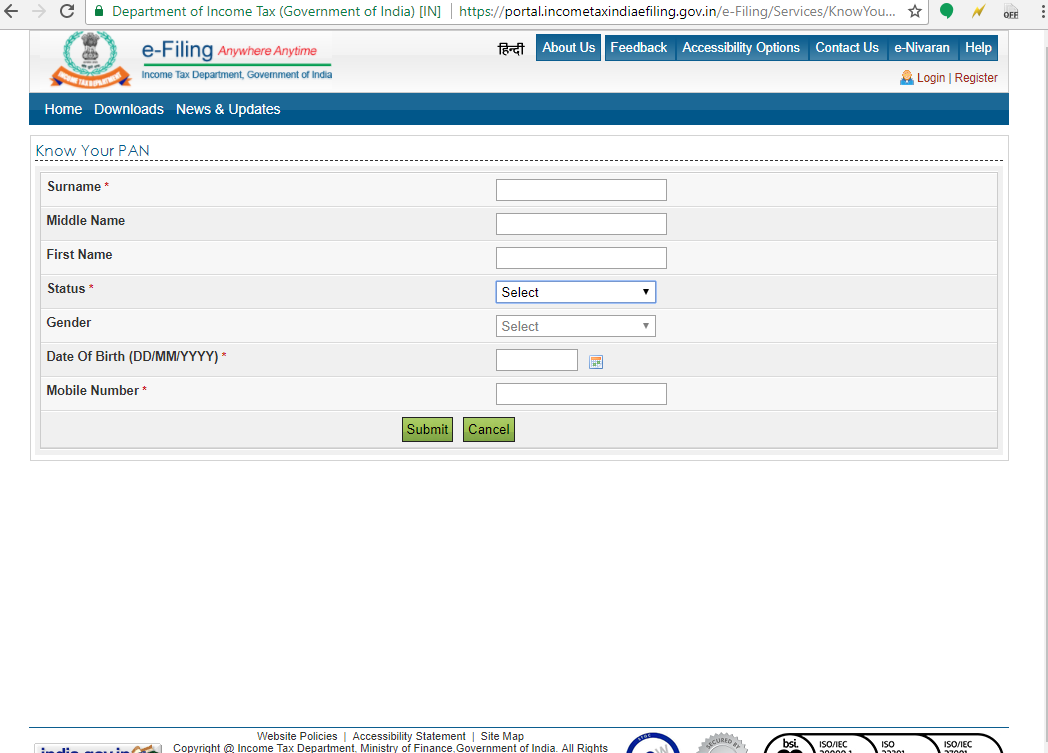

2. After clicking on it, just enter Pan and you will see a screen like this, giving details of your Jurisdictional Assessing Officer (AO)

So, knowing your Income-tax ward is quite simple.

Though filing for your tax returns is a relatively easier task, the sheer amount of time pressure at times forces human errors. If you wait till the end to file your tax returns, the chances of making mistakes only goes up. Thus, it is recommended to file your returns at the earliest.

If you are a salaried individual, it is recommended to verify your Form 16 as soon as you receive it and file for the returns as soon as possible, if everything looks good. This would allow you to meet the deadline and have enough time on hand for any modifications or clarifications that might come your way.

The idea of an ITD circle is to reduce the burden on the income tax department and look into cases that needs human attention. Human attention, because a lot of the processes have been automated and taken care of electronically. Only when a case cannot be handled, the AO comes into the picture.

If due to some reason or the other your tax return comes back to you, knowing your Income tax ward might be helpful.

FAQs

- Who is an AO and what is his role in tax return?

An AO or assessing office is appointed by the income tax department to assess income tax returns that taxpayers submit. In the event that there are any differences or discrepancies, they are responsible to send out notices to respective taxpayers and get the required information. They are assigned to different parts of the country and have designated seats. - Do I always have to reach out to the AO?

No. The role of an AO comes into the picture if there are any discrepancies. Taxpayers who have no issues with their returns don’t even need to bother themselves with an AO or ward or circle. Once when you receive a notice from the income tax department related to any differences in the return, you can consider reaching out to the AO for additional information or clarification. - Is there any other way to find out the ward or circle list?

The two methods involved above are the only ones, with the help of which you can find out your ward/circle list. In either case, you will have to login to the income tax e-filing website with the help of your PAN number. If you remember your password, you can use the second method, or else the first method is your best bet. - Can I avoid getting any notices?

Yes. Firstly, you must file your returns to avoid getting any notices. Secondly, if you carefully go through all the segments of the tax return before filing and verify them with your Form 16, you can reduce any chances of any errors and thus any notice.

Comments

0 comments

Please sign in to leave a comment.