Dividend received from any Indian company is taxable in the hands of investors from FY 2020-21. Earlier dividend income was exempt from tax as the company had paid dividend distribution tax. The Finance Act, of 2020 abolished dividend distribution tax. Hence, dividend received from shares and mutual funds is now taxable in the hands of the investors.

TDS on dividend:

- Dividend on shares is taxable @ 10% u/s 194 if it exceeds Rs. 5000/-.

- Dividend on mutual funds is taxable @ 10% u/s 194K if it exceeds Rs. 5000/-.

- In the case of non-residents, TDS is deducted @ 20%.

Where do I find the amount of TDS on dividends?

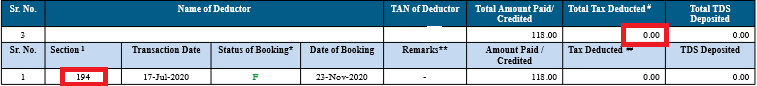

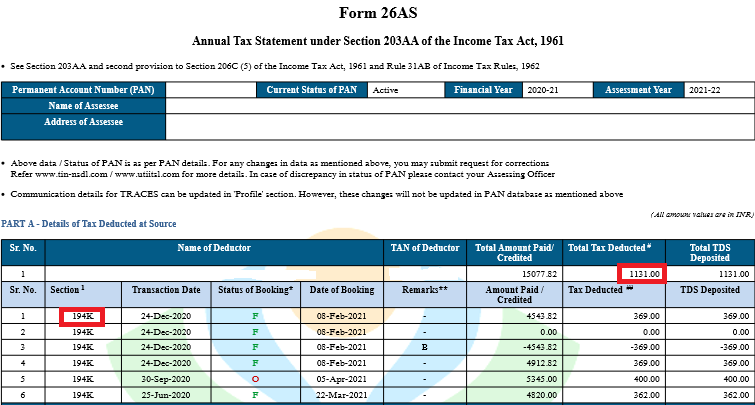

TDS on dividends can be found in Form 26AS. (See sample Form 26AS below)

- In case of Shares:

2. In the case of Mutual Funds:

Comments

0 comments

Please sign in to leave a comment.