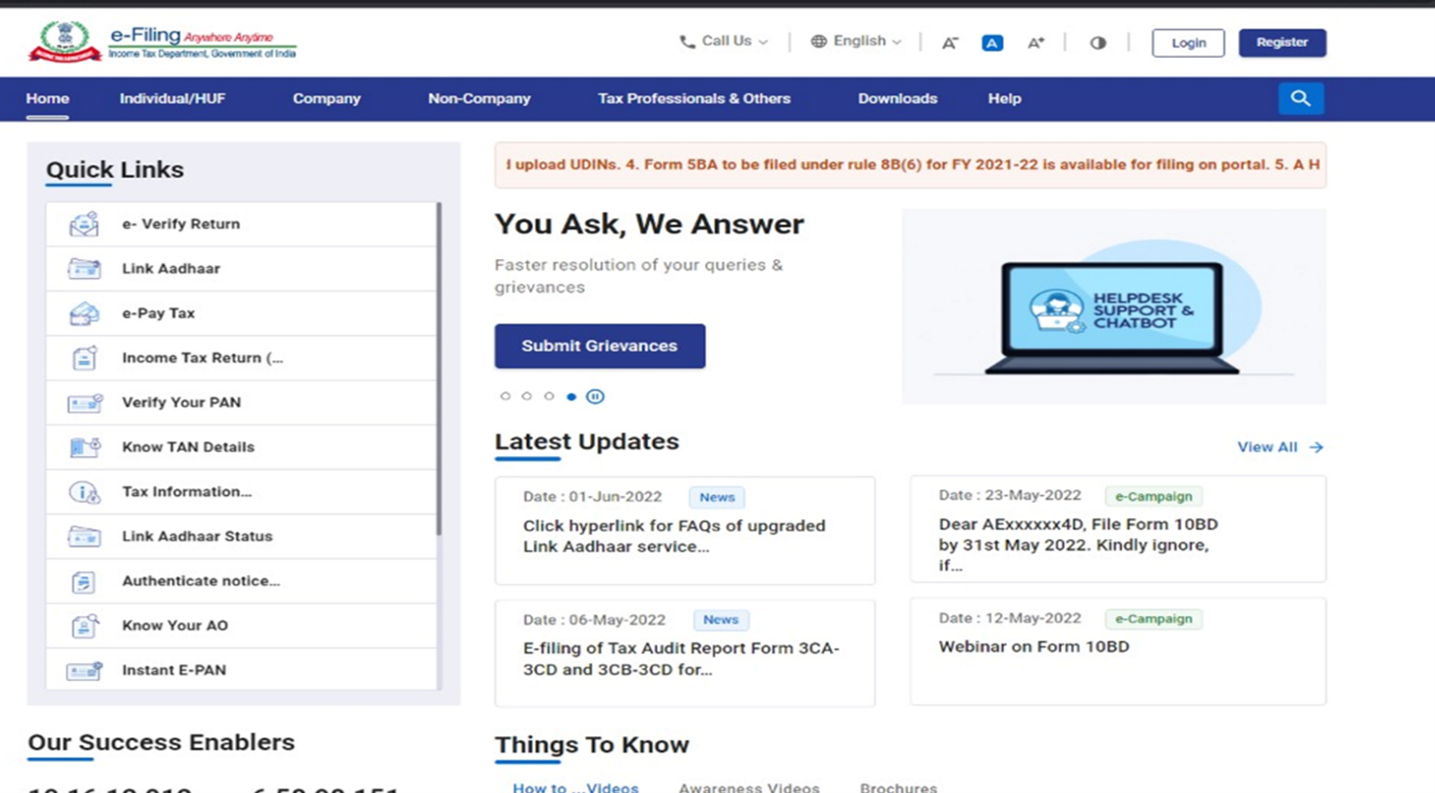

Step 1: Go to the e-Filing portal homepage.

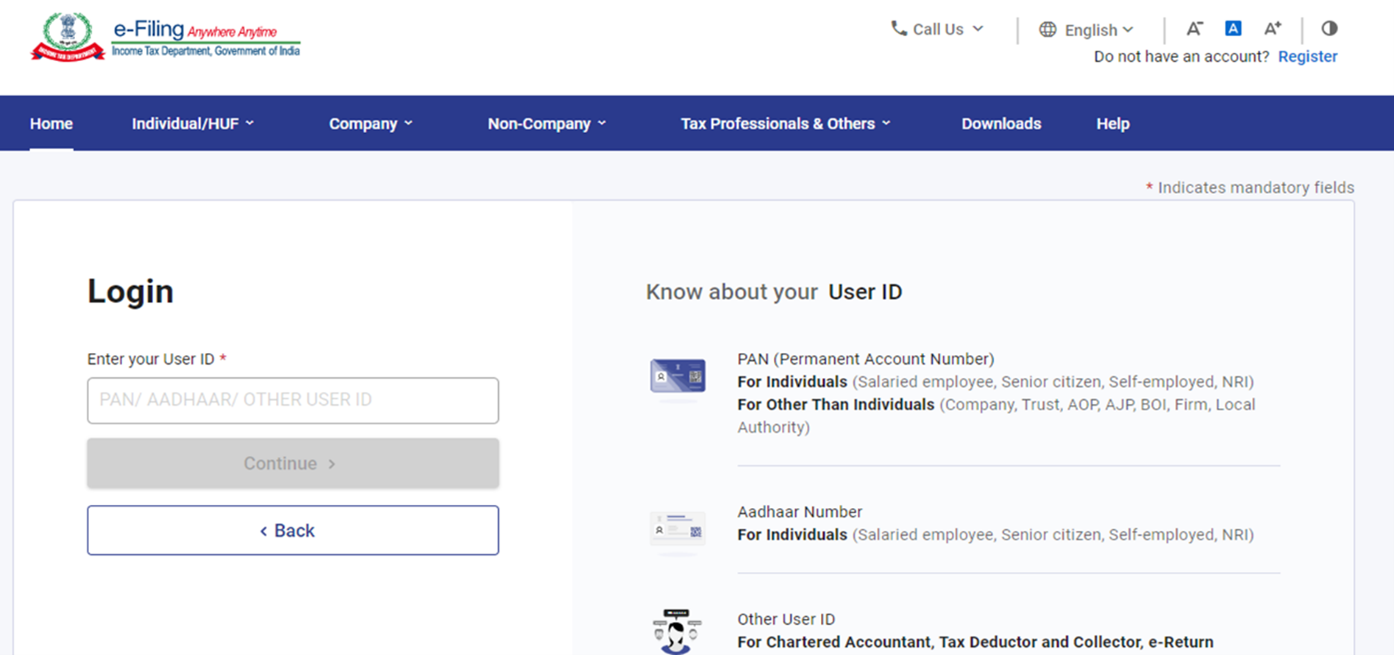

Step 2: Enter the user ID and password.

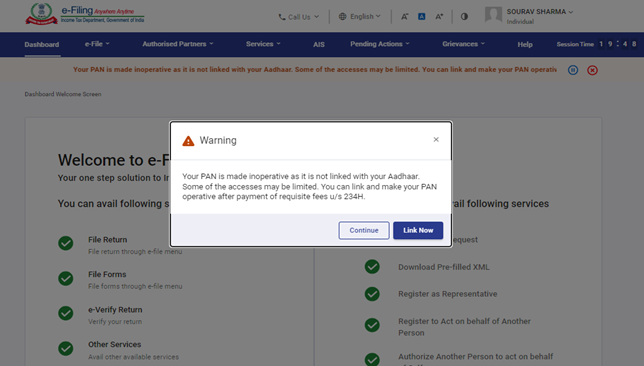

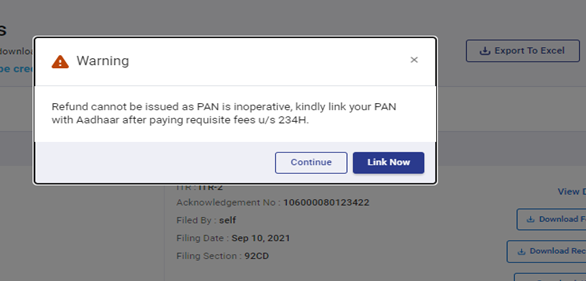

For individual users, if PAN is not linked with the Aadhaar, you will see a pop-up message that your PAN is made inoperative as it is not linked with your Aadhaar.

To link the PAN with Aadhaar, click on Link Now button else click Continue.

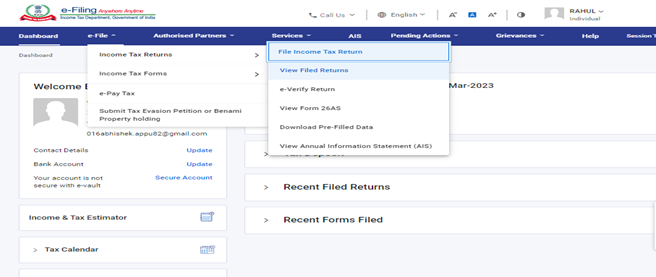

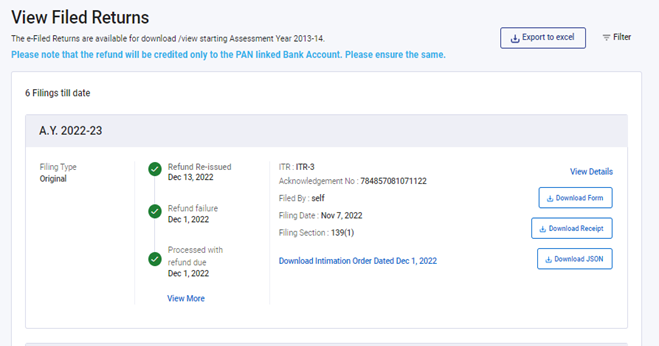

Step 3: Go to e-File tab > Income Tax Returns > View Filed Returns.

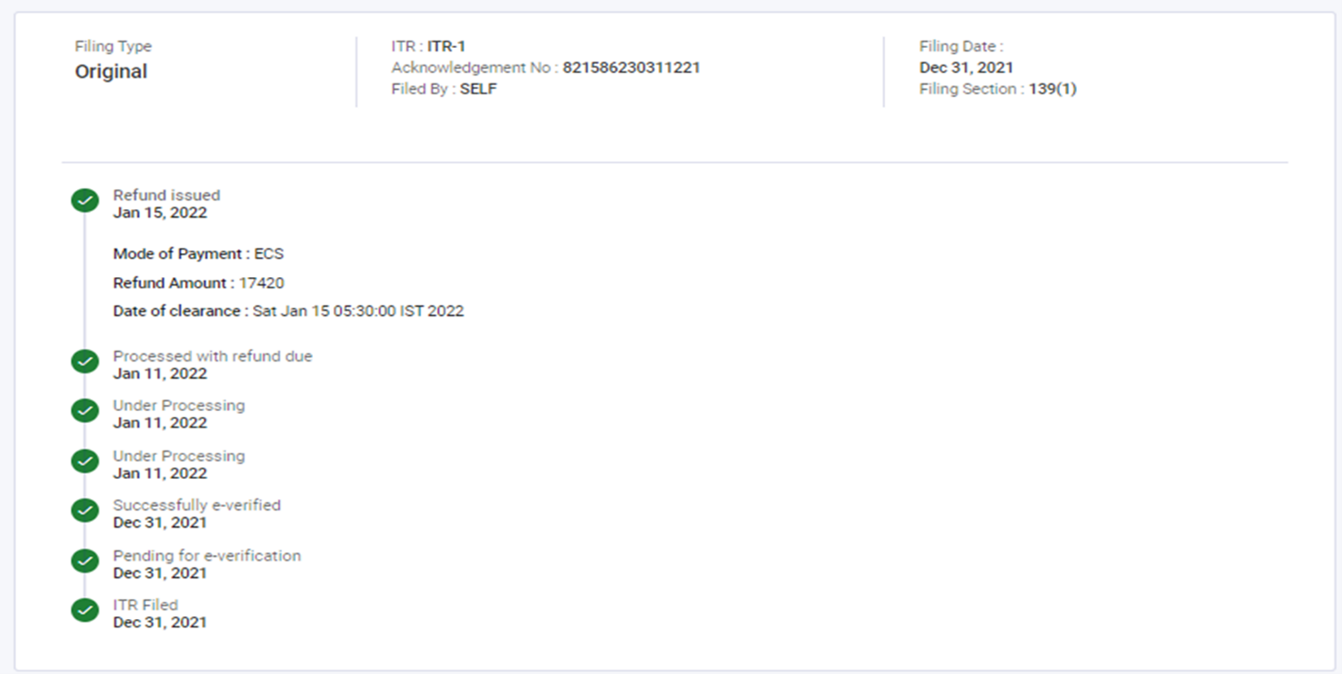

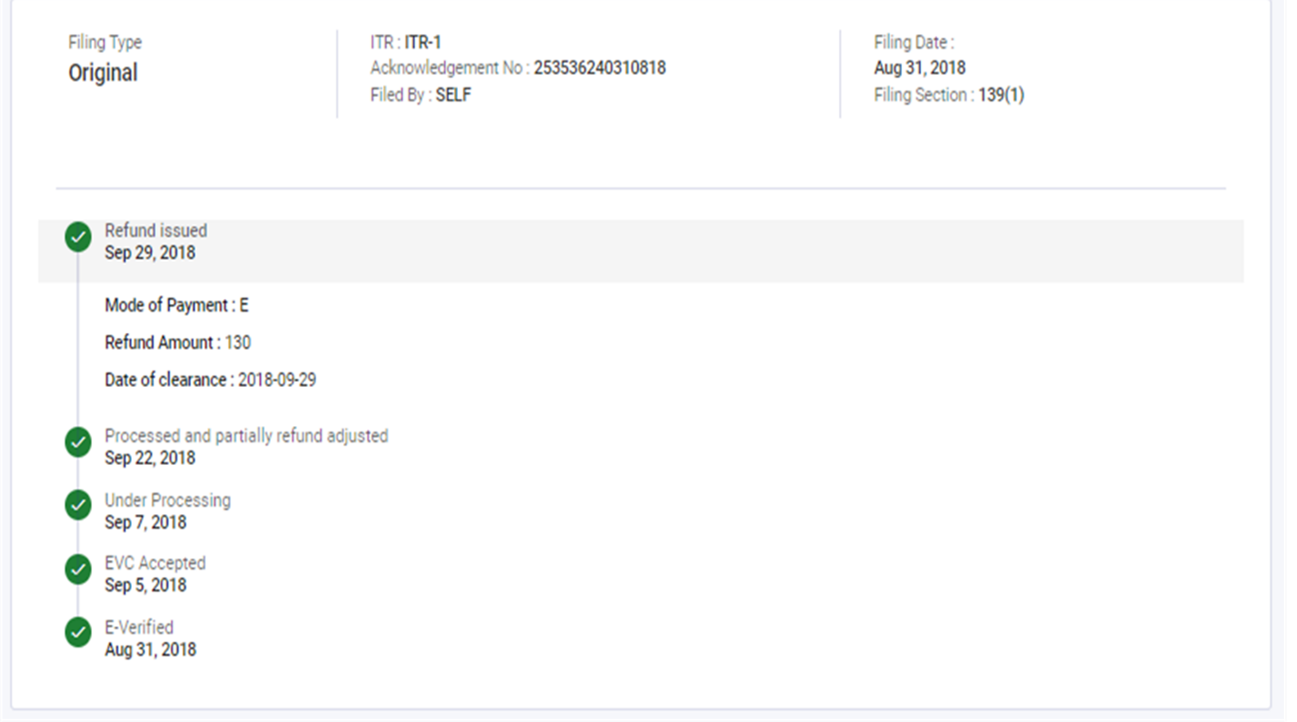

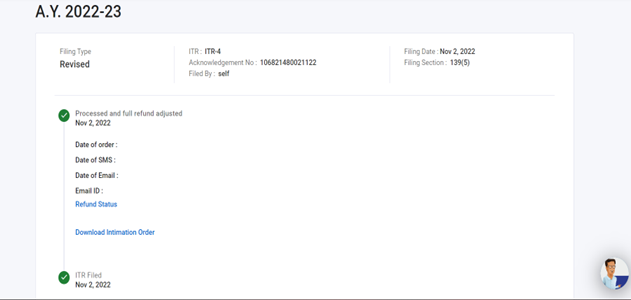

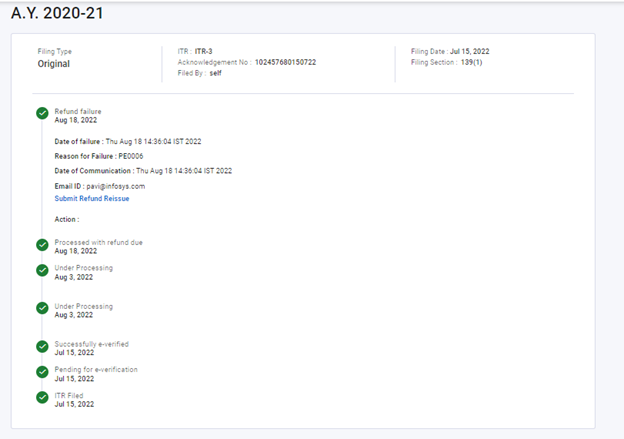

Step 4: Now you can check the refund status for the desired Assessment year.

Click on View Details and here you can also check the life cycle of filed ITR.

Status 1: When refund is issued:

Status 2: When refund is partially adjusted:

Status 3: When full refund adjusted:

Status 4: When refund is failed:

Note: If your PAN is inoperative, your refund will get failed and you will see a warning message to link your PAN with the Aadhaar.

Comments

0 comments

Please sign in to leave a comment.