There are only a couple of scenarios where an individual taxpayer in the country can still choose to file their returns using the paper mode. Firstly, if you are a senior citizen, above 80 years old or if you are a small taxpayer whose annual income does not exceed INR 5,00,000 and you are not expecting any tax refunds for a fiscal year.

For everyone else, filing tax returns must be done electronically. But your tax filing is not considered to be complete by only filing your returns. There is an additional step involved as well. When you complete filing your tax returns, the income tax department will send an acknowledgement form.

This confirms that the income tax department has received your returns and expects you to verify the same. The verification step ensures that you are aware that a tax return is being filed on your behalf and you verify the same.

Few years prior, the only way to verify your tax return was to take a printout of the acknowledgement form sent by the income tax department, sign the form and send it to the Centralized Processing Centre located in Bengaluru.

However, over the years the income tax department has incorporated several additional ways of getting the verification done. Most of them are electronic and thus reduce a lot of manual work. Which in turn results in quicker tax returns.

The following are methods of ITR-V eVerification that you can choose. You only need to follow any one of the these to file your returns.

- EVC of ITR through net banking

Only a handful of the banks in the country offer this service. You can login to your net banking account and look for e-verify option. From there you can generate a 10 digit alpha-numeric number or the electronic verification code (EVC).

- EVC of ITR through your bank account

Even this facility is available only with a handful of banks. You need to pre-validate your bank account number, post which you can generate EVC.

- Verify via Demat account

This method is a bit similar to verification via bank accounts. You need to pre-verify your demat account number post which you can generate EVC.

- Verify through ATM

The income tax department has provided permission to only six banks to offer such services. You can visit their ATMs and use the ‘pin for e-filing option’. This will allow you to generate an EVC.

- Aadhar card verification

Alternatively, you can verify your returns with the help of your Aadhar card and OTP service.

It is important to note that the EVC generated is a unique number and is associated with your PAN. And there can only be one EVC for a PAN. If your return requires any modifications or revisions, you will have to generate a new EVC for return.

“Electronic Verification Code” is a code generated by the Income-tax Department for electronic verification of identity of the person filing the Income-tax Return.

The EVC can be used by a Verifier being an Individual to verify his Income-tax Return or that of an HUF of which he is the Karta in Income-tax Return Form 1, 2, 3 or 4 or the Income-tax Return Form filed in ITR 5 or 7 of any person in accordance with Section 140 of the Income-tax Act, 1961.

If you are not able to e-verify ITR-V and wish to post it, then read this article.

Below are the ways to e-verify the Income-tax return:

- If your total Income is above Rs. 5 lakhs or you have a refund to claim, you need to e-verify through your Net Banking account.

- If your total Income is less than Rs. 5 lakhs and there is no refund to claim, you can receive "EVC" through E-mail ID and Mobile Number.

- E-verify through Bank ATM.

- E-verify through Aadhaar OTP.

- E-verify through Demat Account Number.

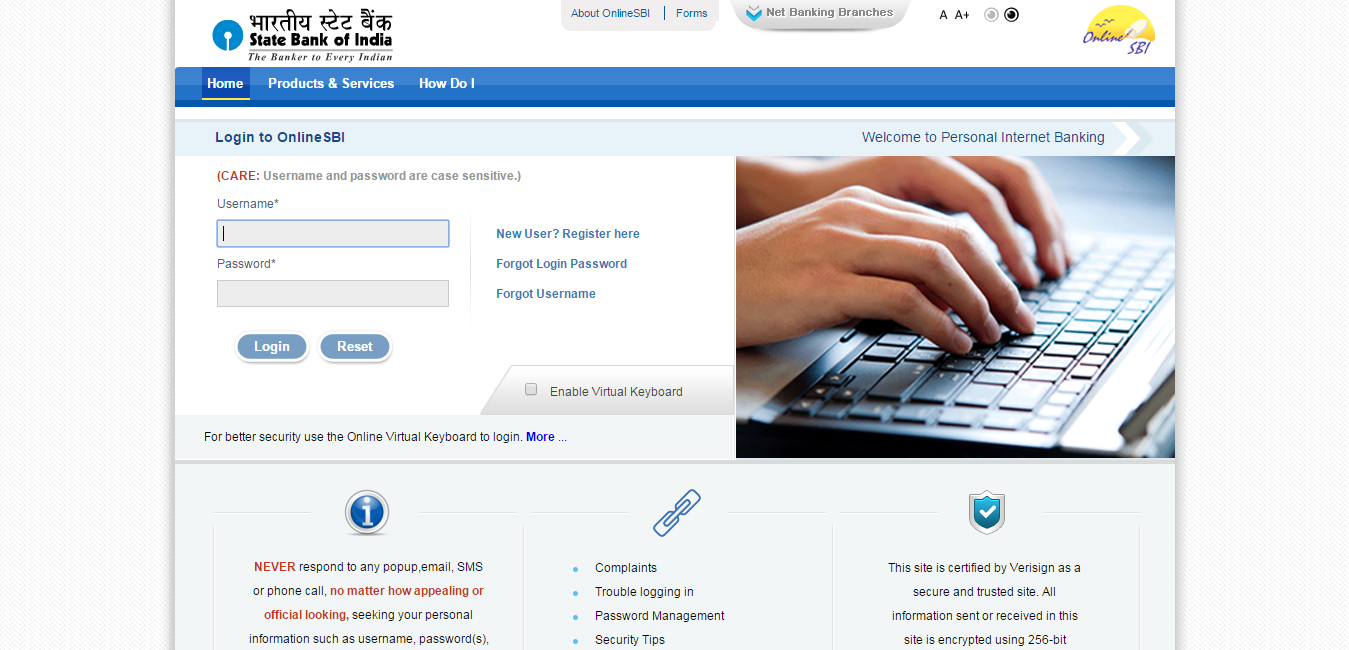

1. E-verify through Net Banking

(a) Check whether you fall under eligible Banks for this purpose or not from here:

https://incometaxindiaefiling.gov.in/e-Filing/ResetPassword/netBankingInst.html

Click on your Bank Name and login (we have taken SBI as example).

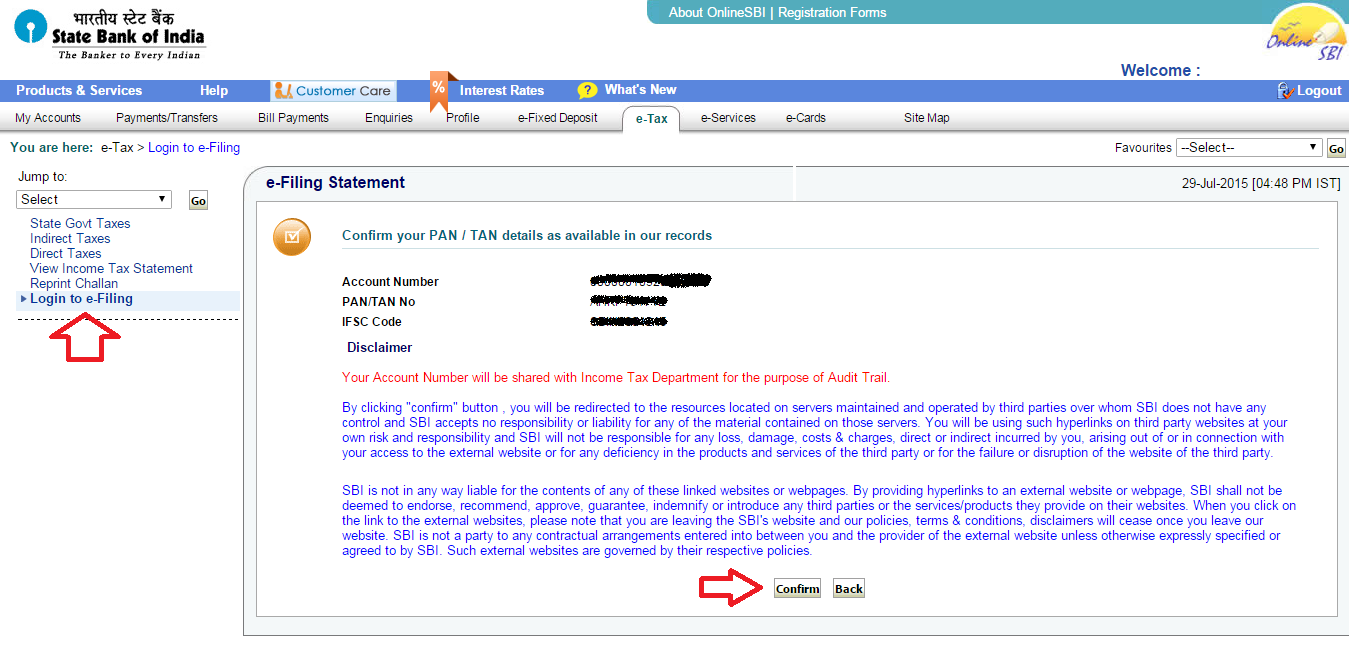

(b) Find out option to login in e-filing website and enter the e-filing portal.

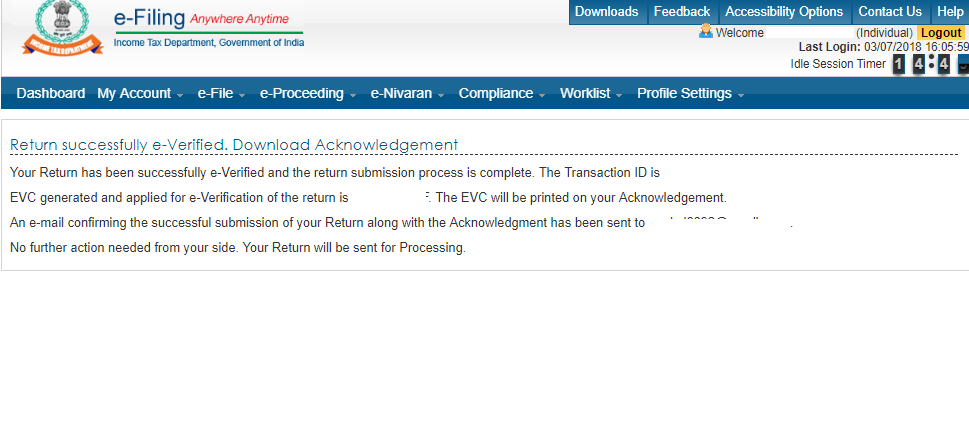

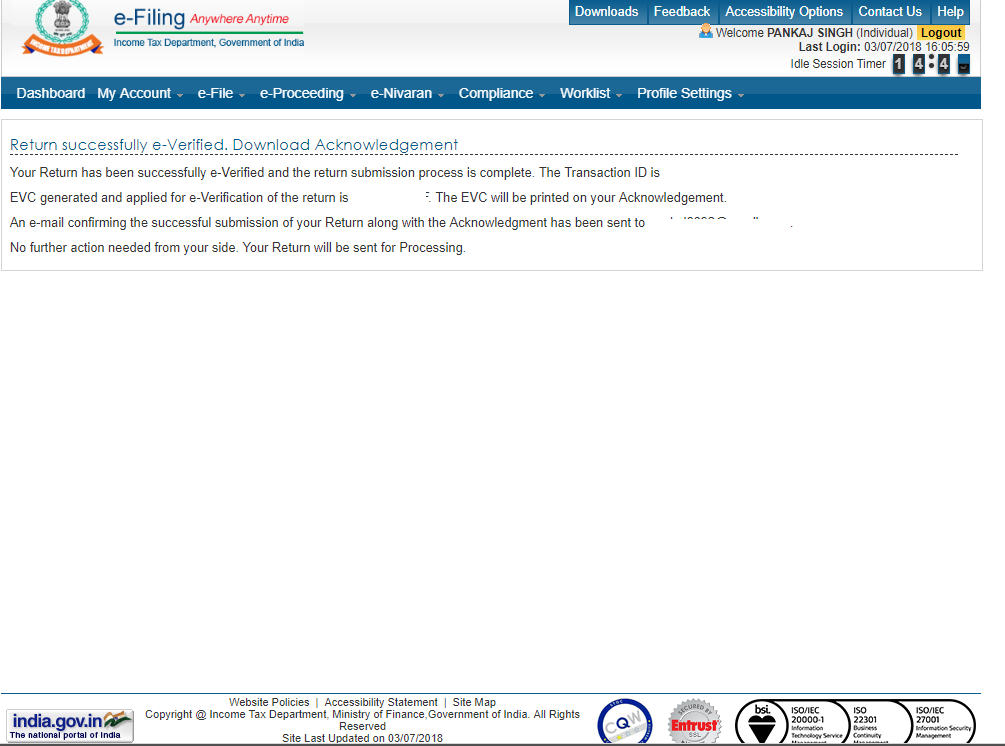

(c) Click on e-Verify link.

(d) Click on "Continue" button to confirm e-Verify process.

(e) You will get a confirmation message. No further action required afterwards.

2. E-verify through E-mail ID and Mobile Number

(a) From the top menu, select "Generate EVC" under the section "My Account".

(b) Now go to "My Account" >> "e-Verify Return"

(c) Click on Option 1 to enter the EVC received and e-verify your return.

(d) You will get a confirmation message. No further action required afterwards.

3. E-verify through Bank ATM

Swipe your ATM card in Bank ATM>>Click on PIN for e-filing

(a) You will receive an OTP on your registered mobile number.

(b) Login to e-filing portal & select option to e-verify return using your Bank ATM.

(c) Enter your EVC on e-filing portal >>Verified.

4. E-verify through Aadhaar OTP

Go to e-filing portal >> Generate OTP >> Enter OTP received on registered mobile number >> Return will get verified.

5. E-verify through Demat Account Number

(a) Go to e-filing portal >> Pre validate your DEMAT account number

(b) Validate your DEMAT account number >> Click on e-verify link

(c) Select option to e-verify using DEMAT account details >> Generate OTP

(d) Enter your EVC on e-filing portal >> Verified

The above are some of the most preferred modes of ITR-V eVerification. Depending on which method is the most convenient to use, you can choose them. In the event none of the above methods are there to pick, you can still verify your returns. You would have to take a print out of the ITR acknowledgement form and sign the document. You then have to post the document to the address mentioned at the bottom of the form.

It is important that you verify your tax returns. Unless you verify your returns, the income tax department would not begin its processing.

FAQs

- What is EVC?

EVC stands for Electronic Verification Code and is a 10 digit alphanumeric code. The code is sent to the registered mobile number of the taxpayer, which essentially identifies them correctly. - Is it mandatory to verify your returns?

Yes. If you do not verify your returns, the income tax department would not begin the processing of your returns. And your return would be tagged as invalid. - Are there any benefits of e-verification?

Yes. E-verification is quicker as compared to the relatively older method of signing the acknowledgement form and sending it to the CPC. It allows for faster return processing as well. - What are the methods for verifying my tax return?

There are about six different ways by which you can verify your tax returns. They are mentioned above.

Comments

10 comments

My evc no still not sent to my mobile or email id

8219104016

12345balliballi@gmal.com

8219104016

My Tax Return is selected for Expert Review and seems no attention is payed to it since 3 days. I have made the payment of Rs 2800 and the Last date of return filing of 31-Aug-2018 is fast approaching. I feel cheated. Please attend so that the Return is filed before 31-Aug-2018.

pradnyaalate@gmail.com

vinayalate@yahoo.com

+91 9561388899

Can you file my tax return ? I have made a payment of 24690.

Please reach me on +91-9920838031

bipi7785@gmail.com

If you have given "X" Bank Account Number during filing for your return to be processed.

Now you are e-verifying through "Y" Bank Account.

will my return be processed okay and to which bank account will my money be processed to?

If I e-verify through Bank ATM or Adhar number will me return be processed okay?

Or is it mandatory I e-verify only through netbanking if I have returns to be processed.

Please send my itrv confirmation mail to my mail I’d bigind32@gmail.com.my pan no is AEDPI8373M

AEBPJ8942D

AEBPJ8942D

Please sign in to leave a comment.