Who is an Assessing Officer?

The assessing officer is the Income-tax officer who has the power to compute the taxable income of the taxpayer. He can also ask for the books of accounts and other details of the taxpayer for verification.

How is the jurisdiction of the Income-tax officer determined?

The address mentioned by the taxpayer in his PAN record is used to determine the jurisdiction of the Income-tax Officer.

E.g. Mr Bharath lives in New Delhi. He provided the address of his residential house in New Delhi while applying for PAN. Hence, the jurisdiction of Mr Bharat shall be the Income-tax office, in New Delhi.

What is the importance of jurisdiction?

Due to the Centralized processing system of the Income-tax department, all taxpayers are required to file their Income-tax Returns online.

The jurisdiction plays an important role in case of any correspondence from the Income-tax department. The department issues Notices, Intimations, Orders, etc. to the taxpayer at his address as per their jurisdiction. On the other hand, if the taxpayer wants to file any application (other than online) he may do so only to his jurisdictional Income-tax officer.

How do I identify my Jurisdictional Assessing Officer?

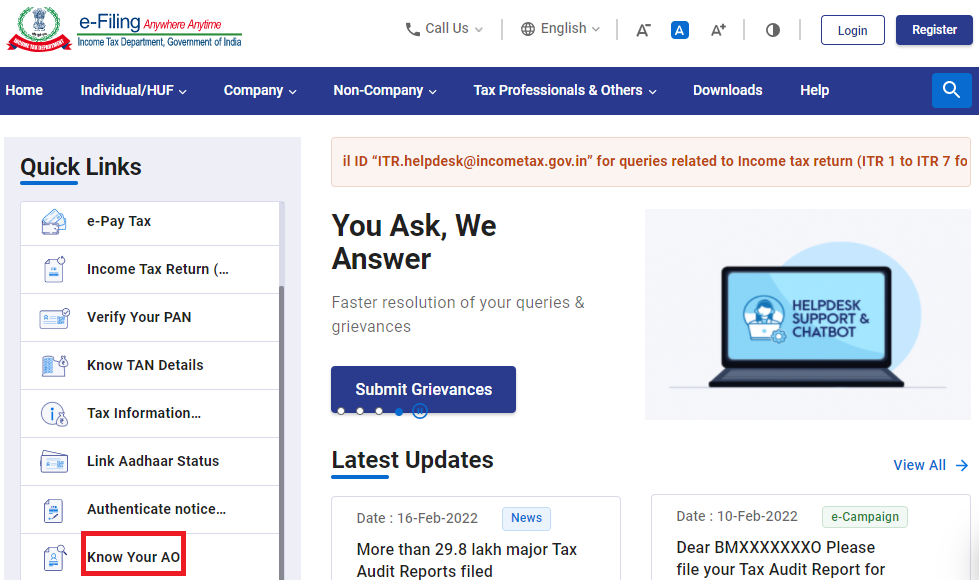

1. Go to the website https://www.incometax.gov.in/iec/foportal

2. At the Quick Links column on the Home page, click on Know Your AO (as shown in the below screen).

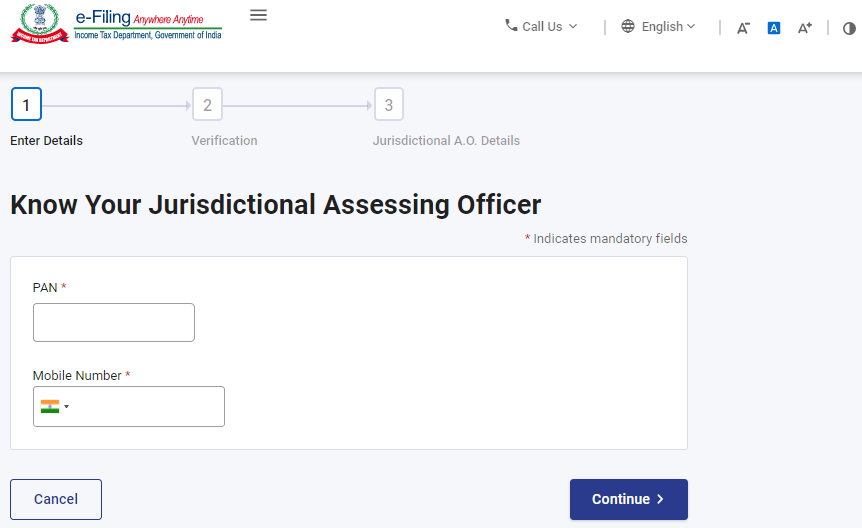

3. Enter your PAN and registered Mobile number (as shown on the screen) and click on Continue.

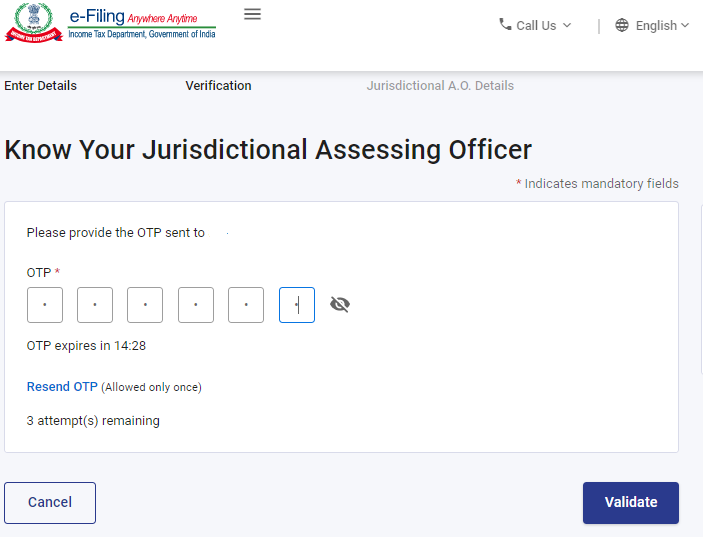

4. Enter OTP received on your registered mobile number and click on Validate

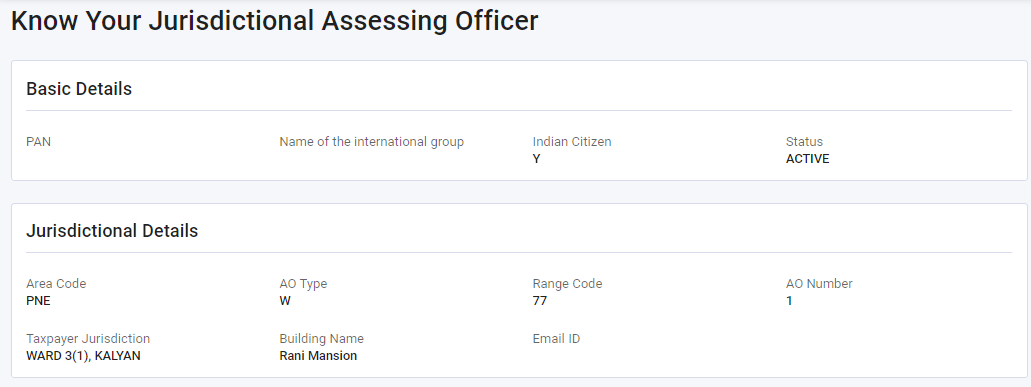

5. You will get your Jurisdictional Assessing Officer.

How do I change my jurisdiction in the Income-tax records?

If the taxpayer changes his city of residence, he should change his jurisdiction by applying to the Income-tax department.

E.g. Miss Sheetal shifted to Bangalore from Indore due to her new job. Her old jurisdiction was Indore. However, for future correspondence with the Income-tax department, she is required to change her jurisdiction to Bangalore.

In such cases, the taxpayer is required to inform the existing jurisdictional Income-tax officer about such change by way of a written application.

Comments

0 comments

Please sign in to leave a comment.