Below are the steps to claim 'unclaimed TDS (Other than Salary)'

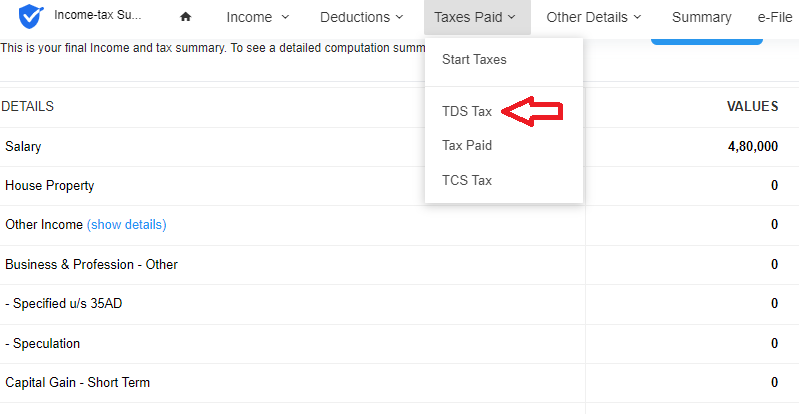

Step 1: Browse to Taxes Paid >> TDS Tax

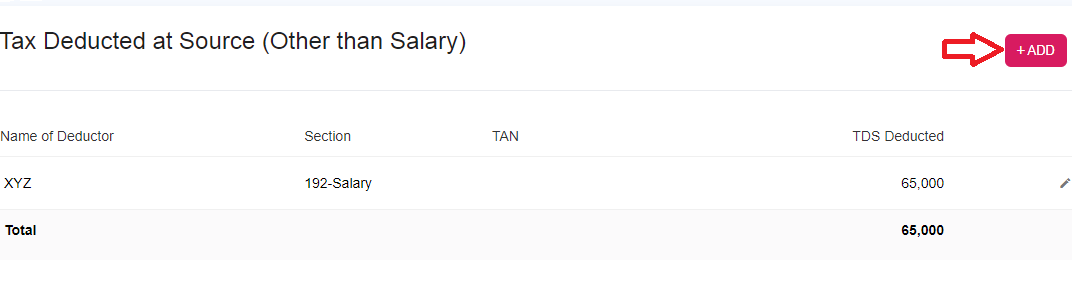

Step 2: Click on Add button:

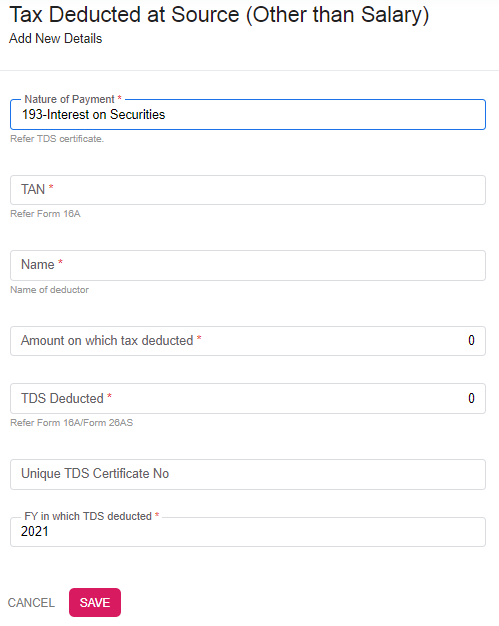

Step 3: Fill up the necessary details. You may refer to your 26AS or Form-16A given by the deductor. Click Save:

Please remember to add the Income amount (amount received) in the respective Income section (page) also, else your computation may be wrong and the return will be treated as defective.

If any queries, please write to myitreturn@skorydov.com

Comments

1 comment

how to claim refund of TDS deducted in AY 2019-20 ?

Please sign in to leave a comment.