Every taxpayer who has an annual income beyond the limits set for exemption should definitely file an Income-tax statement consisting of details such as total income, deductions and much more information. This statement is known as Income-tax Return (ITR).

The main intent of a taxpayer while filing for an Income-tax Return is to get back a refund of the extra amount paid to the Income-tax Department as tax. By filing for an Income-tax Return, a taxpayer is going to obtain his tax refunds conveniently without much hassle.

There are many reasons why taxpayers end up paying an extra amount of tax to the Income-tax Department. It might be that the taxpayer has paid an advance tax and in this process, he has paid an extra amount. Moreover, if TDS has been deducted from the salary of an individual it might have been deducted more than what is actually liable to be deducted. So, filing an ITR will help in getting back the refund.

After Income-tax Return has been filed by the taxpayer the Income-tax Department will process the request. For the processing of an Income-tax Return request, there have been some parameters set by CBDT (Central Board of Direct Taxes). Based on these parameters, sometimes an Income-tax Return Request might be selected for assessment. Income-tax Assessment is the process by which the Income-tax Department will collect the information and review the information that has been filed by a taxpayer.

Forms of Assessment

There are various forms of assessment of Income-tax Returns.

- Self Assessment

In the self-assessment form, the taxpayer will find out the payable tax by himself. The taxpayer will club up his income available from various sources, adjust the deductions and exemptions and finally arrive at the taxable income. The taxpayer can make calculations for TDS or advance tax to be paid and finally find out if any amount is to be paid or not. He will have to pay this amount before filing for an Income Tax Return. - Summary Assessment

In summary assessment, there is no human intervention. Here the main task involved is to match up or check the information provided by the taxpayer while filing an ITR with the information available with the Income-tax Department. If there are any arithmetical errors, incorrect claims, etc. then those will be directly adjusted by Income-tax Department. In the case of this type of assessment, the taxpayer is informed by intimation under section 143(1). - Regular Assessment

Here the Assessing Officer of the Income-tax Department will conduct the assessment to find out that the taxpayer has neither understated his income nor has overstated the expenses. - Best Judgment Assessment

The Best Judgment Assessment will occur in scenarios such as no response from a taxpayer on notice issued by the Income-tax Department or if a taxpayer is not able to comply with the audit ordered by the Income-tax Department, etc. In this case, the Assessing Officer will take into consideration the argument of the taxpayer and then pass a judgment based on the information and records available. - Income Escaping Assessment

Suppose, the Assessing Officer finds out that a taxable income has escaped assessment; he can order for assessment and reassessment. The time limit within which an assessment can be re-opened is 4 years from the end of the specific assessment year.

What is Regular Assessment tax?

Tax on regular assessment is the tax that a taxpayer is required to pay against a notice of demand from the Income-tax department. So when notice of demand is received and it is found that some additional tax is required to be paid, the same shall be deposited under the head "Tax on Regular Assessment".

Regular Assessment tax due dates are during an assessment year of a taxpayer’s Income-tax Return after the last financial year has been over.

Where to pay Regular Assessment tax?

You can pay your Regular Assessment Tax either online or at the bank i.e. by Offline Method.

For making the payment in both methods, you will need Challan No.280.

For the Online method of payment of Regular tax, you will need to visit the website of the Income-tax Department and select Challan 280. The details on the online mode of payment are discussed in the following section.

For making the payment of the Regular Assessment tax by offline method, you will have to visit your bank and collect Challan 280. Later on, you can fill up the details on the challan and deposit your tax amount with the bank.

How to pay Regular Assessment tax?

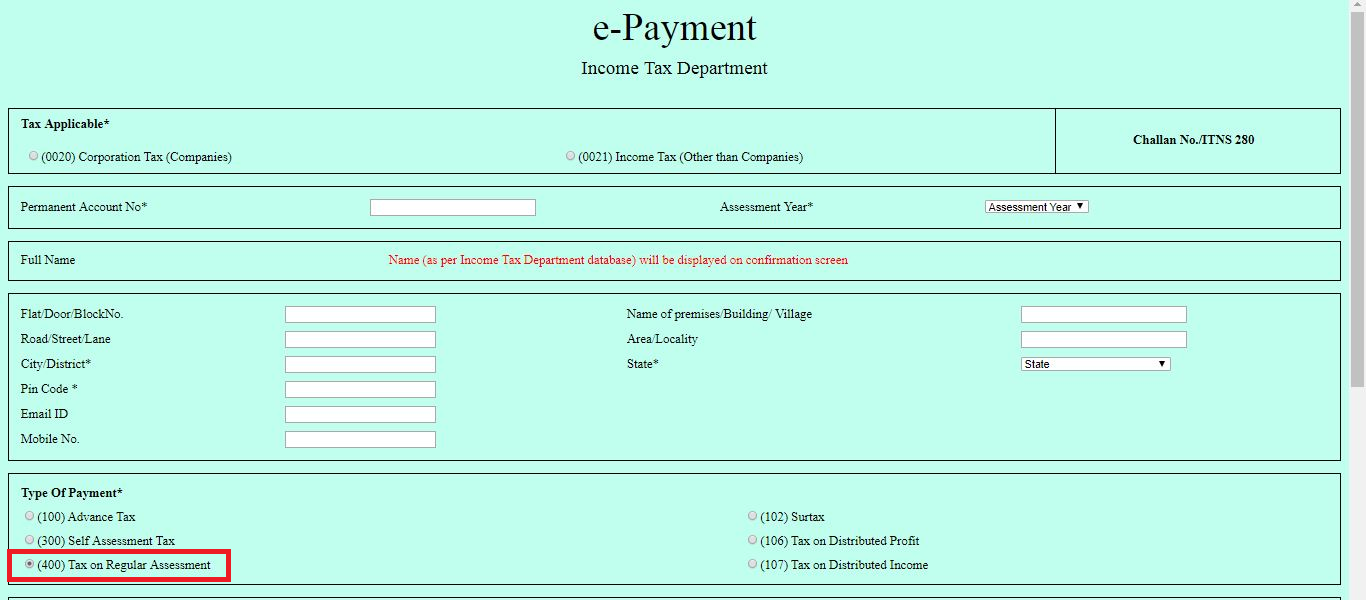

The steps for making payment of Regular Assessment Tax will be the same as that of Self Assessment Tax. The only difference is that in the field of "Type of payment", you will have to select " (400) Tax on Regular Assessment ".

Challan No.280 is needed for making Income-tax payments. The payment might be in the form of Self Assessment Tax, Advance Tax or Regular Assessment Tax; a taxpayer will need Challan No.280 to complete the payment.

- In the first step, you can visit the tax information network of the Income Tax Department and select Challan 280.

- In the next step, you can select go to the Government website and pay your tax.

- The next step is about populating your personal details.

- First, you need to select (0021) Income Tax (Other than Companies).

- Next, you will need to enter your PAN details.

- You will have to select the particular financial year for which you are making the Income Tax payment.

- Next, your address has to be filled in.

- ‘Type of Payment’ is quite important and needs to be filled in correctly.

- You will have to select ‘(100) Advance Tax’ in case of payment for Advance tax.

- Select ‘(300) Self Assessment Tax’ if you are making the payment for Self Assessment tax

- You have to select ‘(400) Tax on Regular Assessment’ for making the Regular Assessment Tax payment.

- There would be two modes of payment available i.e. Net Banking or Debit Card. You need to select your choice of payment option.

- In the next step, you will have to enter the Captcha code and click ‘Proceed’.

- Now, according to the mode of payment selected by you; you will be redirected to the payment page of your bank. Here, you can cross-check all the information once again and click ’Confirm’.

- After the payment, you will obtain your tax receipt on the screen. You need to save the tax receipt for future references.

- The BSR Code and Challan Serial Number on the tax receipt are to be used in your Income Tax Return details to declare that your taxes are paid now.

To know how to pay Self Assessment Tax online, click here

Types of Regular Assessment Tax

According to Income Tax Act, 1961; Regular Assessment Tax means the assessments that are done under sub-section (3) of Section 143 or Section 144.

The Assessments done under Section 143(3) are known as ‘detailed assessment’ or ‘scrutiny assessment’. This is carried on to confirm the correctness of various deductions and claims made by the taxpayer while filing for Income Tax Returns. Furthermore, Scrutiny Assessments are of two types i.e. Manual Scrutiny cases and Compulsory Scrutiny cases.

As said earlier, the assessment made under Section 144 is done according to the best judgment of the Assessing Officer.

Who is liable to pay Regular Assessment Tax?

When a taxpayer receives a notice of demand from the Income Tax Department regarding some additional tax to be paid, the taxpayer has to do the payment under the Regular Assessment Tax.

The Central Board of Direct Taxes (CBDT) has set some parameters based on which a particular Income Tax Return Request is sent for scrutiny. The Assessing Officer would issue the notice of demand under Section 143(2). According to the notice, there has been some need for scrutiny of data for the taxpayer and he will have to share certain information, documents and his book of accounts for the scrutiny assessment. On the completion of the assessment, the Income Tax Department informs the taxpayer about the amount to be paid.

If the taxpayer does not agree to the assessment made by the Assessing Officer, he can raise a rectification request under Section 154 or even can opt for a revision of the Income-tax Return application under Section 263 or Section 264.

Conclusion

Hence, by the regular assessment form taxpayer would get an opportunity to substantiate the expenses and income which have been declared along with the deductions and exemptions. The payment of Regular Assessment tax by the online method is also easy and convenient without much hassle.

FAQs

- Are there any benefits of paying tax online?

Yes definitely, the most important benefit of tax payment online is that it is a time-saving option. Moreover, it is more convenient as there will be no need for travelling to the bank or office for making payment. - Whom should I contact in case of any issues while making online payment of tax?

While making tax payments online, if you are facing any issues with the NSDL website you can connect with the TIN call centre. For any payment related issues, you can connect with your bank’s customer=service representative.

Comments

0 comments

Please sign in to leave a comment.