If you failed to e-Verify your Income Tax Return ( ITR ) or sending the signed ITR-V copy to CPC Bangalore then you may not have received your refund yet.

You can follow the steps below to e-verify your ITR using Aadhaar, bank account, internet banking or Demat account without logging into your DIT account:-

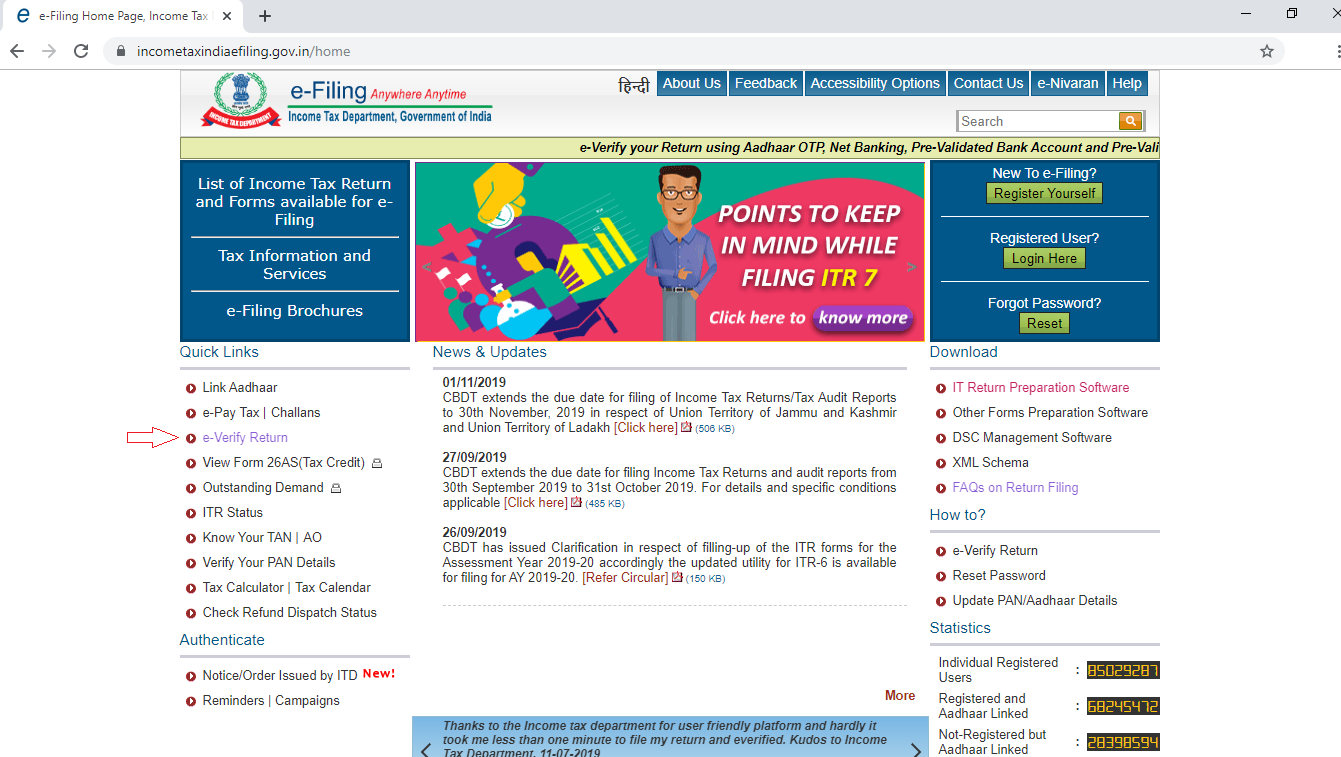

Step 1: visit Income-tax departments e-filing portal and click on option "e-Verify Return" on the left side.

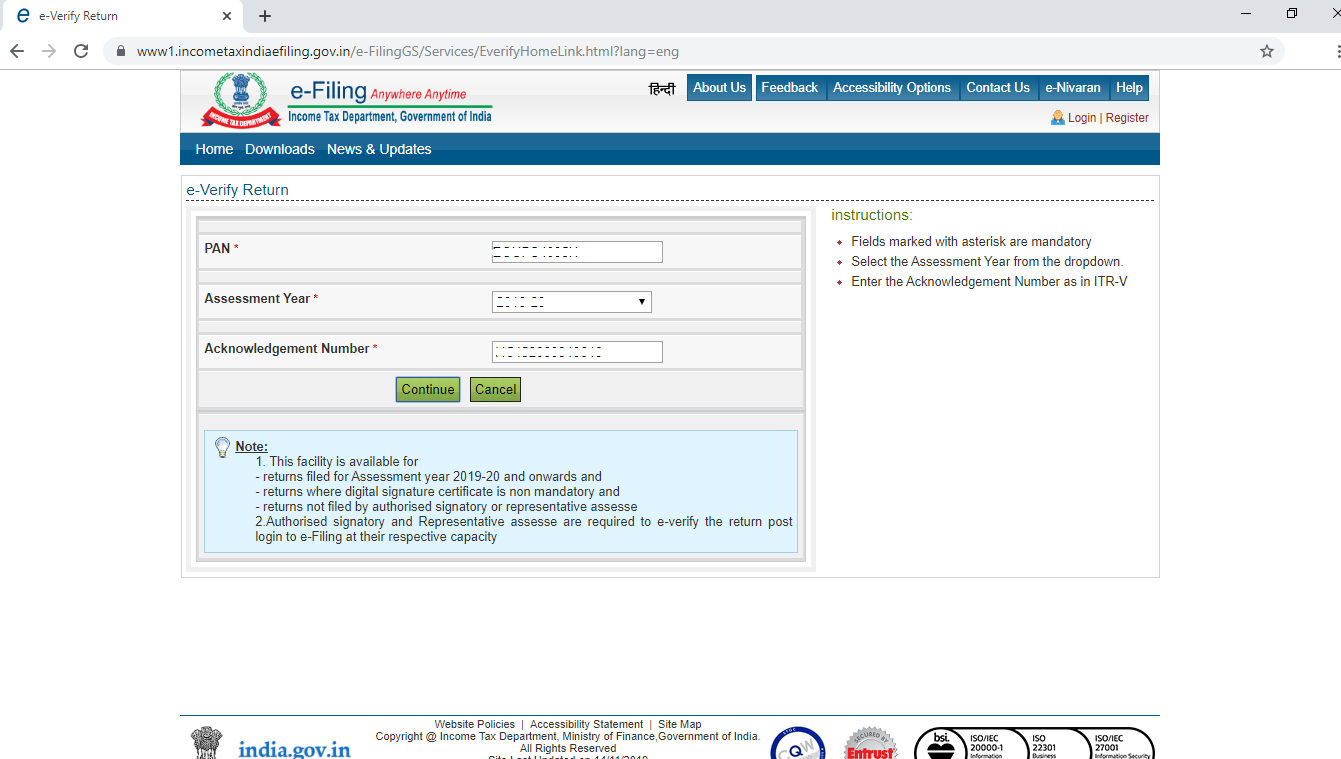

Step 2: Enter your PAN, select Assessment Year, enter Acknowledgement Number and click on continue.

Please refer your ITR-V copy to find your Acknowledgment number of that particular Assessment Year.

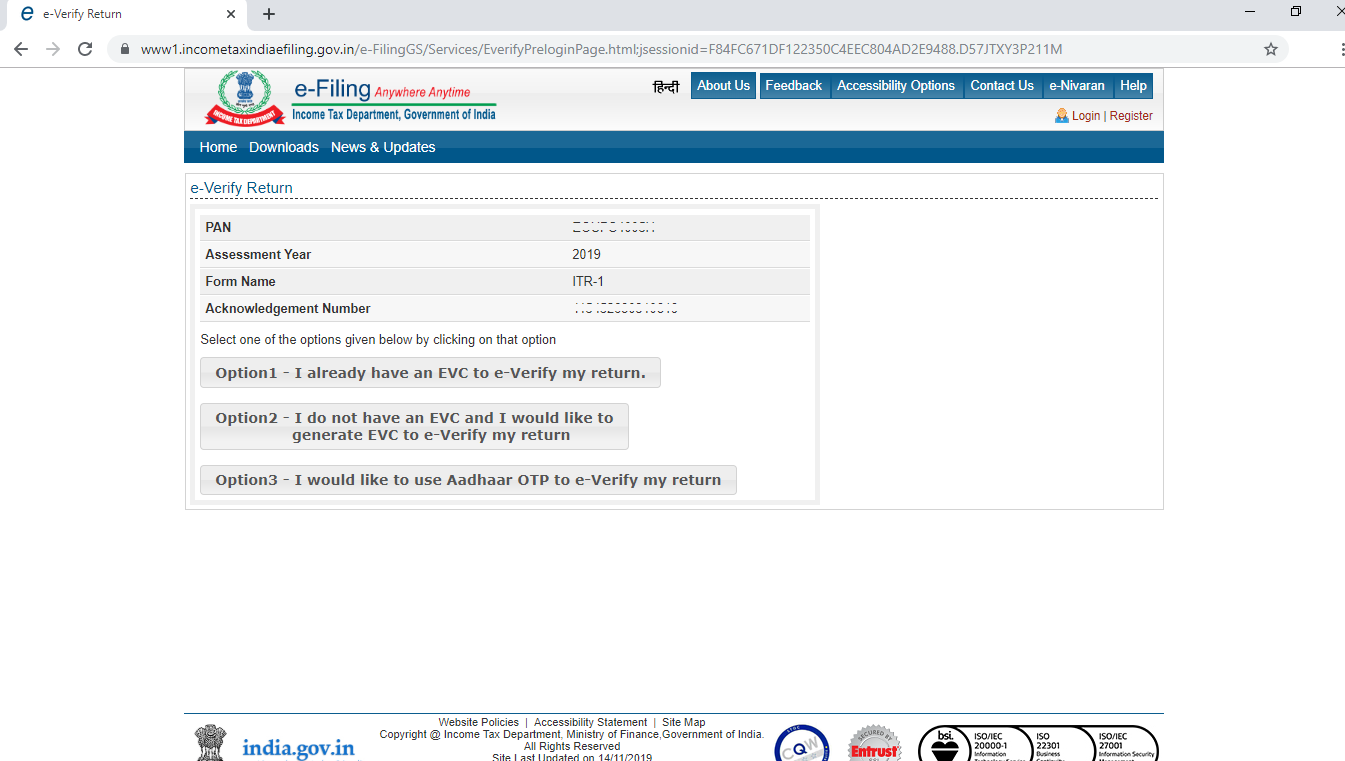

Step 3. Select one of the applicable options:

Option 1: If you already have an EVC.

Option 2: If you want to e-Verify your return using Internet banking, Account number or Demat account.

Option 3: If you want to e-verify using Aadhaar OTP.

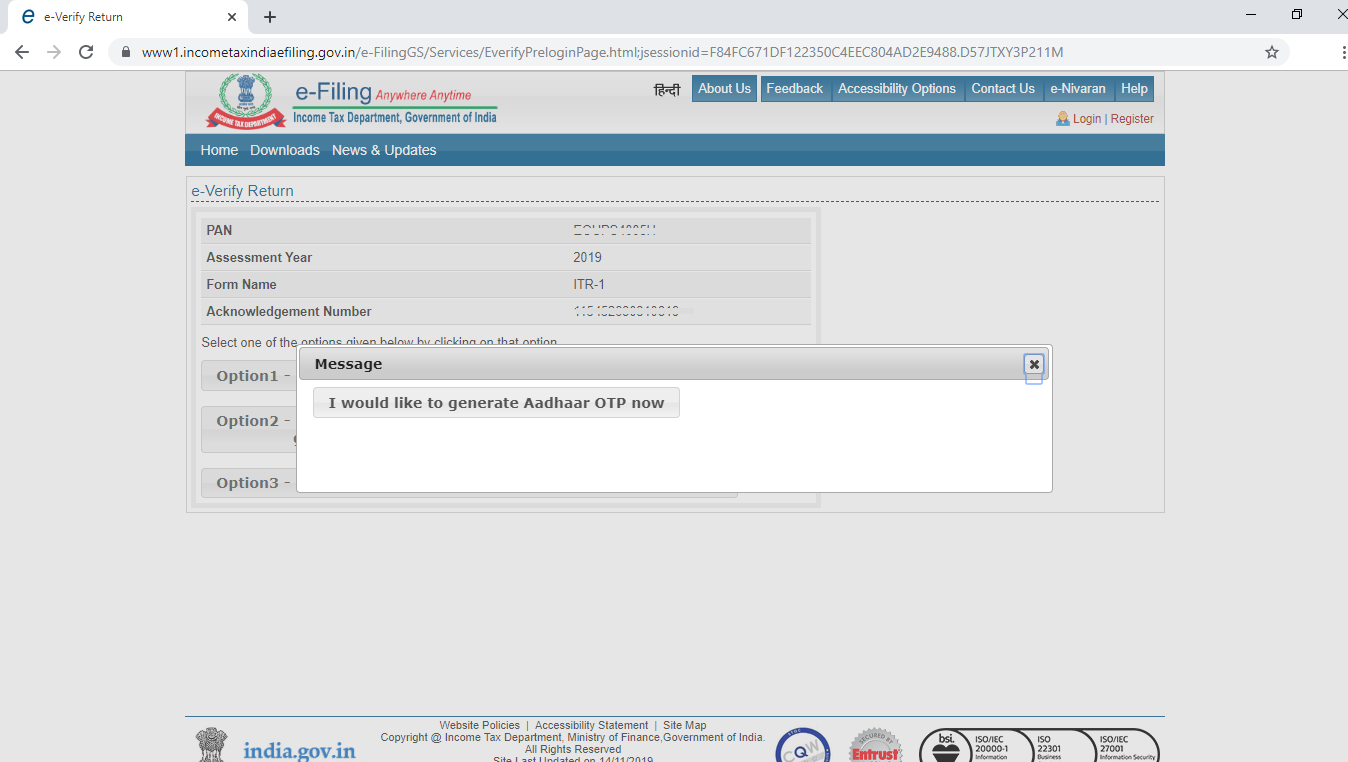

Step 4: Select the applicable option.

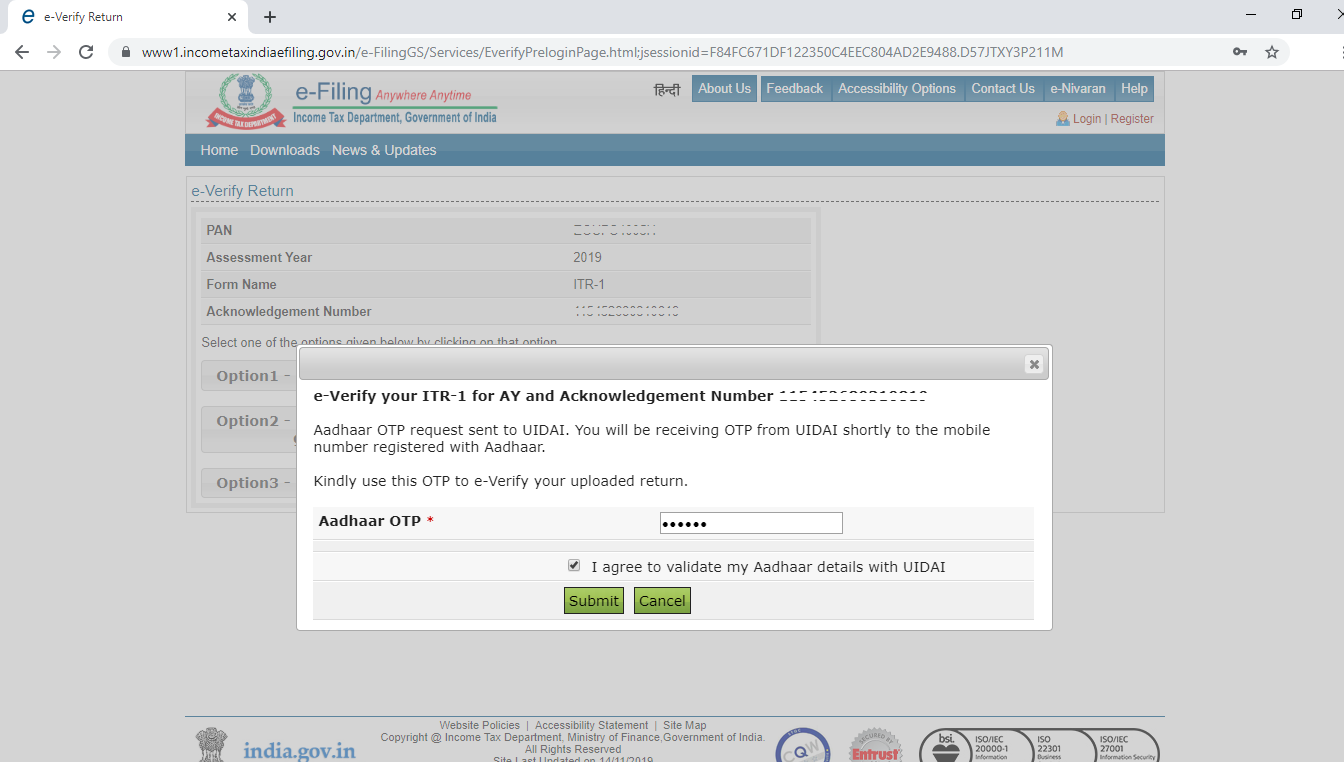

Step 5: Enter the OTP received, select "I agree to validate my Aadhaar details with UIDAI" and click on continue.

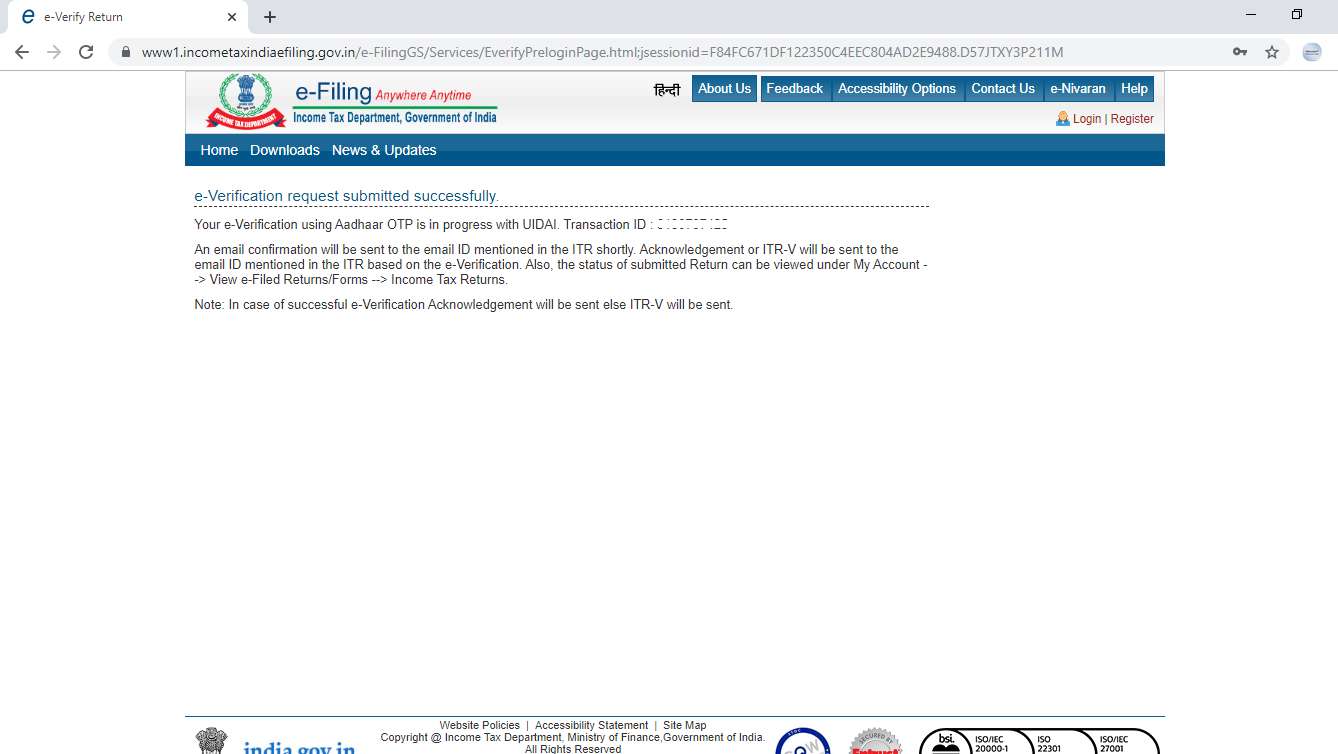

Step 6: You will get below screen after submission.

If your return is successfully e-Verified you will receive a successful verification email in your registered e-Mail id.

In case you want to e-Verify your return using other options please refer below article:

Comments

0 comments

Please sign in to leave a comment.