According to the laws laid down by the Government of India, it is mandatory for individuals who have a specified amount of annual income to file for an Income Tax Return and within the specified time limit. Income Tax Return is a form in which an assessee files information about his income and the tax that is to be paid to the Income-tax Department.

The law in India states that tax returns need to be filed every year by an individual or by a business that has received a specific amount of income from any source like wages, interest, dividends, capital gains, etc.

Reasons for filing an Income Tax Return

There are some major reasons for which a taxpayer in India should file for Income Tax Return within the specified time limit.

- For claiming your refunds

There might be scenarios in which a taxpayer might end up paying extra amount of Income Tax due to reasons like more deduction made for TDS, double taxation, more payment made in the form of Advance tax, etc. In such cases, in order to get back a refund of the extra tax paid; the taxpayer needs to file an Income Tax Return.

- Carry forward your losses

The various losses which might have been incurred by an individual or a firm cannot be just shown as exemption so as to carry forward the losses incurred in the previous year. But, the benefits of these can be claimed if the taxpayer has filed for an Income Tax Return.

- To avoid penalty and getting notices

According to the laws, any taxpayer who does not file for Income Tax Returns will have to pay penalty of Rs.5000. This amount might seem to be very petty for many taxpayers but this will remain as an entry in the records of the Department which may not be good in the long run. Moreover, the Income Tax Department sends notices to those taxpayers who do not file their returns or conceal their income.

- Creating financial history for yourself

By filing your Income Tax Return on time, you are creating financial history for yourself. This will be maintained in the book of records by the Income Tax Department and will act as proof of your income and you being financially stable.

Filing for Income Tax Returns and Intimation Orders

Today, with the onset of electronic medium every single task can be done easily by online methods. Similarly, filing for Income Tax Returns can be done easily by using online method known as e-filing. It is convenient and hassle-free to file for Income Tax Returns by using the e-filing method.

During processing of the request, there might be scenarios where the Income Tax Department might find out certain differences in data, wrong entry of information, etc. In such cases, the Income Tax Department will issue a notice for the taxpayer otherwise known as Intimation Order.

The Income Tax Department can issue large number of Intimations under various sections of the Income Tax Act such as Intimation u/s 143(1), Notice u/s 142(1), Notice u/s 148, Notice u/s 139, etc.

One such important Notice issued by the Income Tax Department is Notice u/s 154.

Notice u/s 154

Notice under section 154 of the Income-Tax Act is the rectification order issued by the department in case of mistake apparent from record*.

The Income-tax department may issue such notice in response to a rectification request filed by the Assessee or it can self-generate the rectification order, where they notice any discrepancy in the Income-tax return processed.

*What is mistake apparent from record?

The meaning of “Mistake” from the perspective of section 154 is as follows:

- Mistake includes any arithmetical & clerical errors/mistakes

- Misreading a clear provision of the Income Tax Act

- Applying an inapplicable provision of the act

- Non-following a decision of Jurisdictional High court

- Erroneous application of a provision of the act

- Overlooking a non-discretionary but mandatory provision

Some examples related to these above-mentioned mistakes are:

- Mismatch in Advance Tax.

- Gender specified incorrectly.

- Mismatch in tax credit.

- At the time of filing additional details were not submitted for capital gains.

Income Tax authority may:

- Amend any order passed by it under the Income Tax Act

- Amend any intimation or deemed intimation under section 143(1).Click here, to know more about intimation under section 143(1).

Usually, the assessee who will receive intimation u/s 154 i.e. a rectification has been generated by the Income Tax Department starts worrying about how to resolve my notice received u/s 154.

Let us discuss step-by-step procedure on how to deal with notice u/s 154.

- In the first step, you need to check if you have received the notice u/s 154 under the processing of Intimation u/s 143(1). Here, the assessee will receive a document which has the tabular form of differences in the amounts filed by assessee and those amounts as per the records of the Income Tax Department.

- In the next step, if you have not received intimation u/s 143(1); you need to request for resending intimation u/s 143(1).In case if you have the intimation u/s 143(1), you need to analyze the causes of difference between your records mentioned while filing ITR and those of the Income Tax Department.

- Now, you will need to check Form 26AS which is available on the Income Tax Department’s web portal. In case of absence of certain tax credits, you can get it corrected by your deductor asking him to update the credits. However, if the tax credits are correctly available and marked ’F’ it means everything is right from your side and the Income Tax Department needs to update their records.

- After this, you have to respond to the notice u/s 154 received by you. There would be two responses and you can tick on either one i.e. ‘Rectification Proposal Agreed’ or ‘Rectification Proposal Not Agreed’. You need to specify the reason for not agreeing to the rectification proposal by the Income Tax Department.

- Next, you would need to sign this and send it to the address mentioned on intimation u/s 154 received by you.

Rectification Request for Income-tax Return

Suppose, an assessee is wondering about how to rectify my default return. Then, he can file an online rectification request for defective return.

Following are the steps to file an online rectification:

Step 1:

Login to www.incometaxindiaefiling.gov.in using your User ID, Password and Date of Birth/ Incorporation and GO TO My Account < Rectification Request.

Step 2:

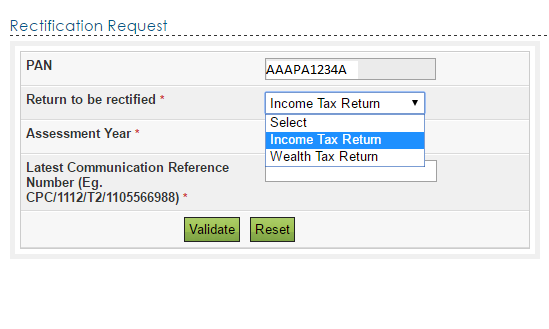

Select Return to be rectified as “Income Tax Return” from the drop down available.

Step 3:

Select the Assessment Year for which Rectification is to be e-Filed.

Step 4:

Enter the Latest Communication Reference Number (as mentioned in the CPC Order) and then click “Validate” button.

Step 5:

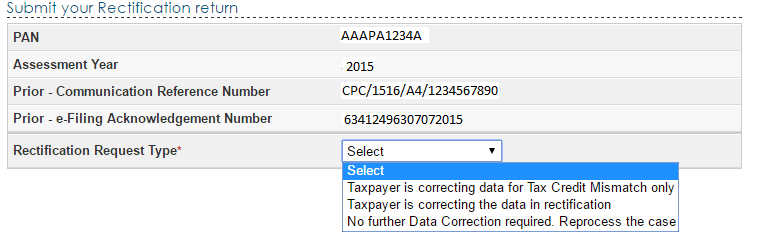

Select the “Rectification Request Type”.

Step 5(a):

On selecting the option “Taxpayer is correcting data for Tax Credit mismatch only”, four check boxes are displayed. You may select the checkbox for which data needs to be corrected. Details regarding these fields will be pre-filled from the ITR filed. User can add a maximum of 10 entries for each of the

selections. No upload of any ITR is required. Now you can enter the tax payment details correctly here.

Step 5(b):

On selecting the option “Taxpayer is correcting Data in Rectification”, select the reason for seeking rectification.

You can select a maximum of 4 reasons. Following are the rectification reasons you may select from:

After selecting the reason you will be required to select the concerned schedules to be changed in the rectification, Option provided for uploading xml and DSC ( in case of audit) .

Step 5(c):

On selecting the option “No further Data Correction Required. Reprocess the case”, check-boxes to select are: Tax Credit Mismatch, Gender Mismatch (Only for Individuals), Tax / Interest Computation Mismatch are displayed. User can select the checkbox for which re-processing is required. No upload of any ITR is required. User can view their 26AS details by clicking on “Click here to view 26AS details” button and view their Tax Credit Mismatch details by clicking on “Click here to view Tax Credit Mismatch details” button.

Step 6:

Click the “Submit” button. A popup appears.

Step 7

Click on “OK” button to submit the rectification.

Step 8

On successful submission, following message is displayed.

With myITreturn notice assistance service, tax experts will help you in handling any Income Tax notices received

You can log in into the web portal of myITreturn, upload your notice and immediately avail the myITreturn notice assistance service.

For more details on this, please click on the below-mentioned link.

Conclusion

Hence, if the Income Tax Department is raising a self-generated rectification request for your defective return and you are receiving a notice u/s 154; you need to respond to the notice definitely failing which the rectification would be done automatically and the return would be computed based on the rectified data. On receipt of any such notices, an assessee should not get panic and rather follow the procedure to resolve the notice received.

FAQs

- Who can file a rectification request?

A rectification request can be filed by the Income Tax Department or it can be filed by an assessee himself. - Should a rectification request be filed online?

If the Income Tax Return request was filed online, then rectification request should also be filed online.

Comments

0 comments

Please sign in to leave a comment.