Please verify your Form 26AS for the concerned year and check if the self-assessment tax/TDS details are present.

If the self-assessment/TDS is present please proceed with the rectification of the ITR form.

Please follow the below steps depicted for rectification.

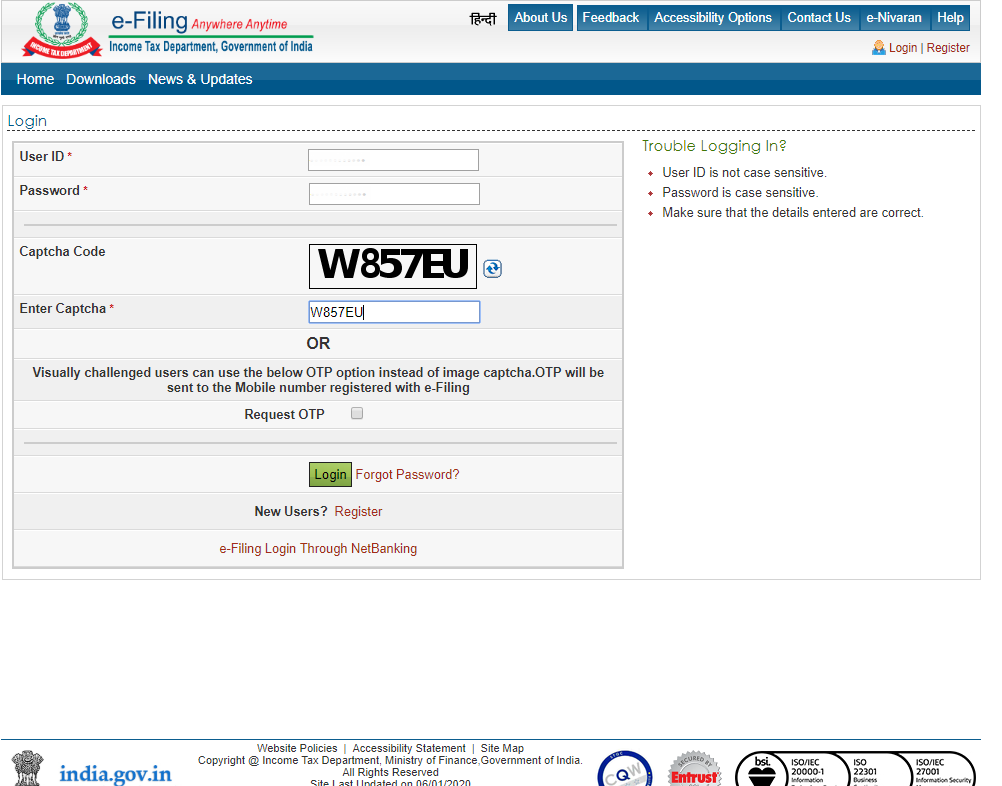

- Login to e-filing portal:

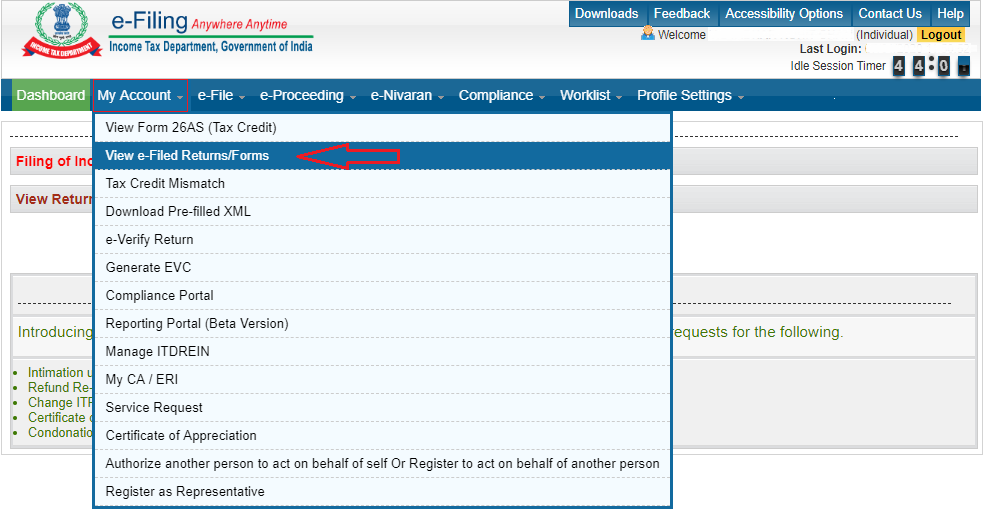

- Click on My account and navigate to View e-Filed Returns/Forms:

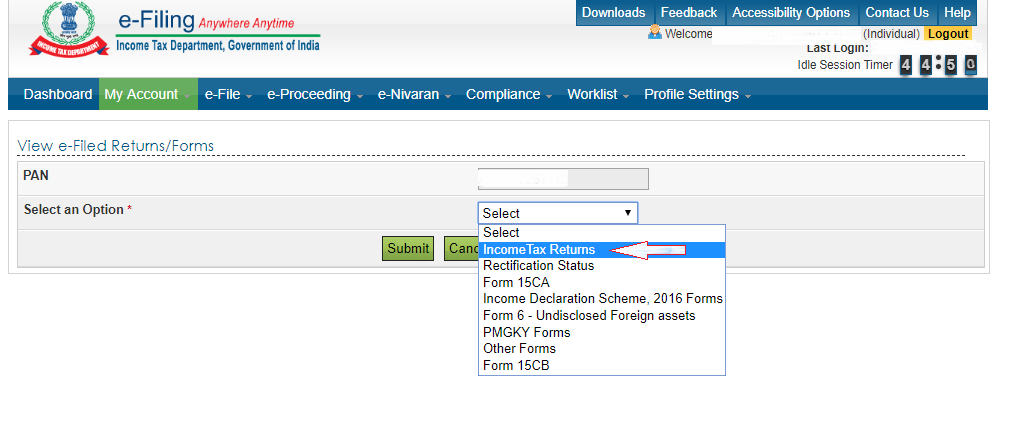

- In e-Filed Returns/Forms select Income-tax Returns from the dropdown:

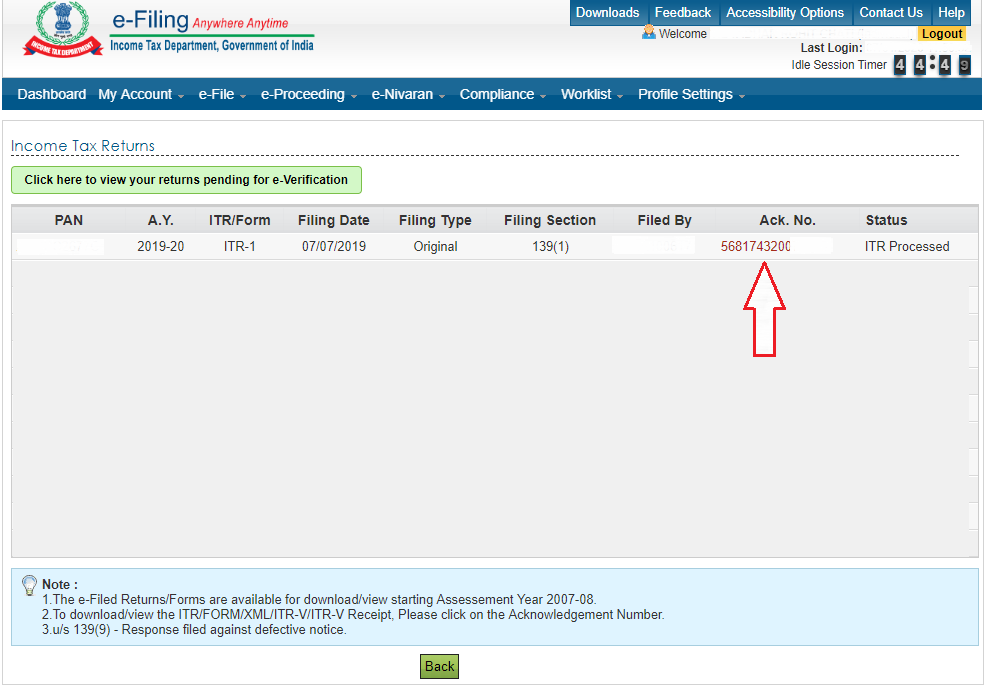

- Click on the Ack. No. for which you want to do a rectification:

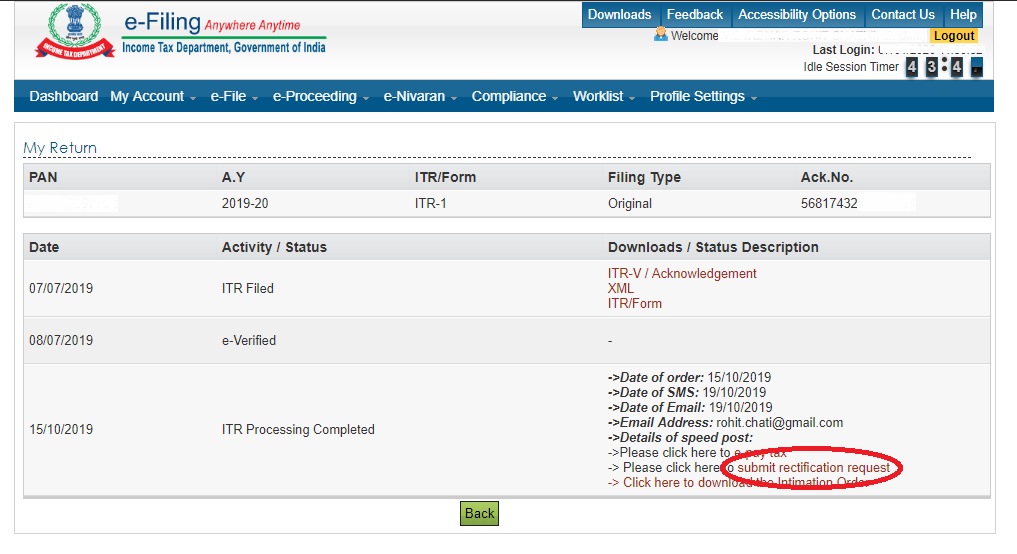

- In this step, click on submit rectification request to proceed further:

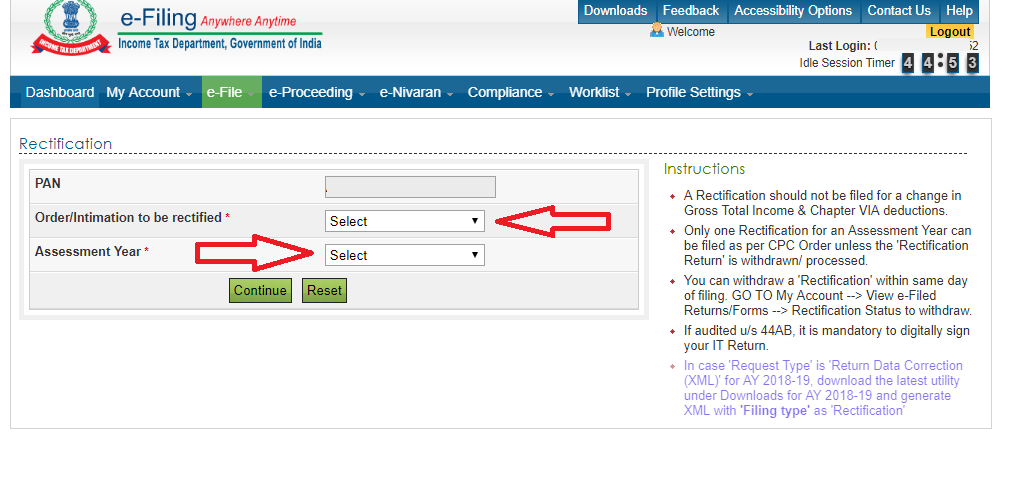

- Select Order/Intimation to be rectified and the concerned Assessment year:

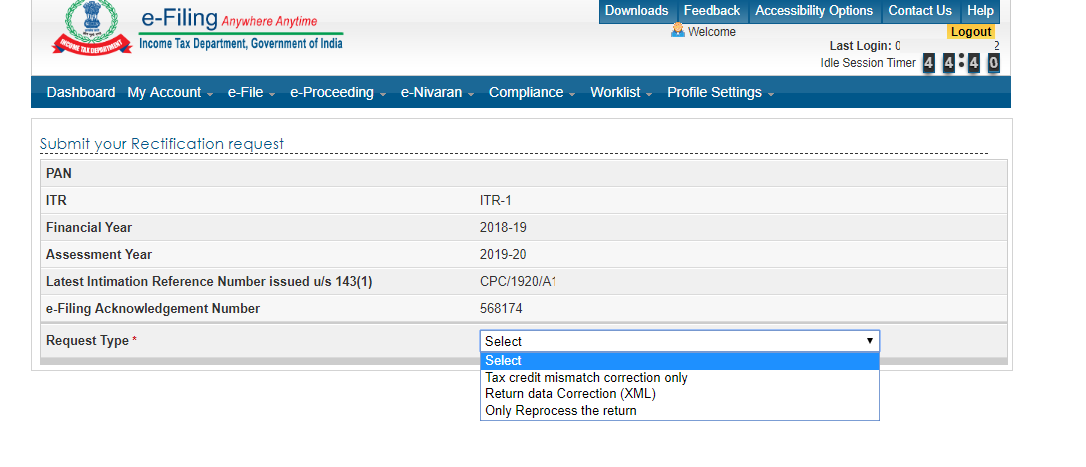

- Select the desired option from the dropdown to submit a rectification request:

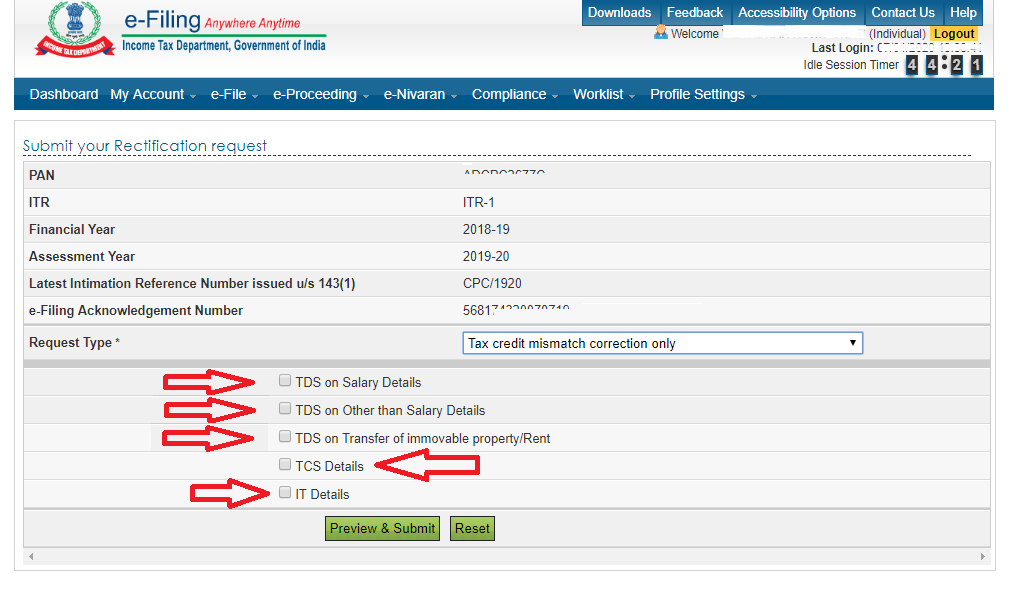

- Select the desired request type for correction of the details in your ITR

Comments

0 comments

Please sign in to leave a comment.