Less refund status can arrive due to multiple reasons. Read in detail for various discrepancies and resolve them yourself.

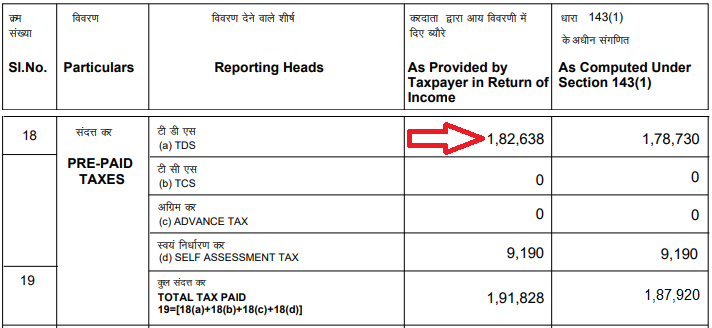

- Discrepancies in TDS

This is the most common reason for most maximum notices issued with demand. If there are any differences in section 18(a) click here to read in detail.

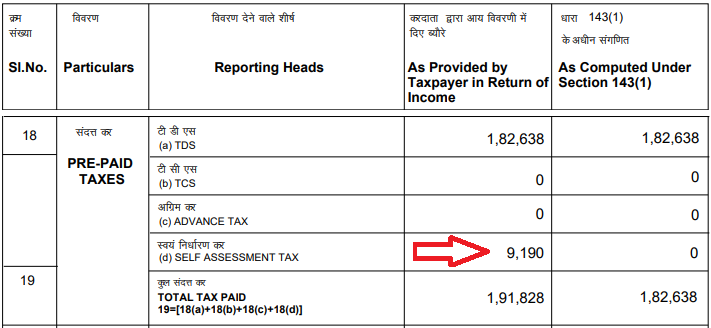

- Discrepancies in Self Assessment tax

If the self-assessment tax amount provided by the assessee does not match as per the department's record such demand can be issued. click here to read in detail.

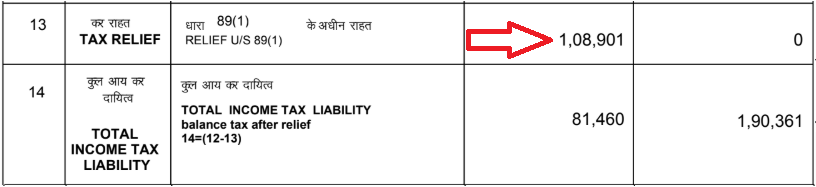

- Relief u/s 89(1) not considered by CPC

If the difference is in section 13 (Tax Relief) please click here for more information.

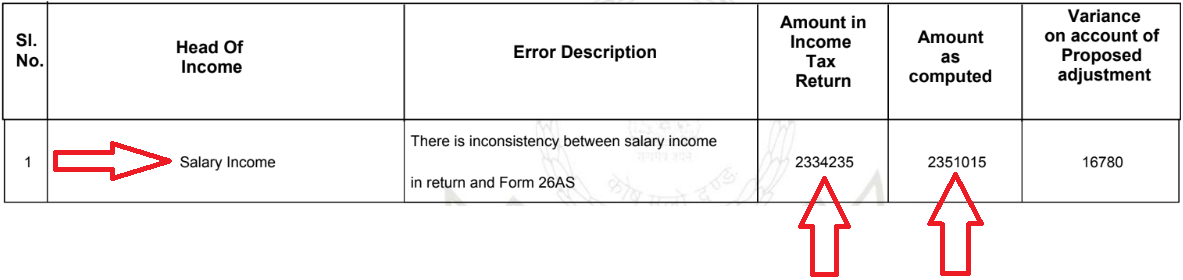

- Inconsistency between Salary Income in return filed and Form 26AS

If the difference is in section 1 (Salary Income) please click here for more information.

Comments

0 comments

Article is closed for comments.