Here is a quick step-wise method to find out if you have received an Income-tax notice or intimation.

- Login / Signup to e-filing portal:

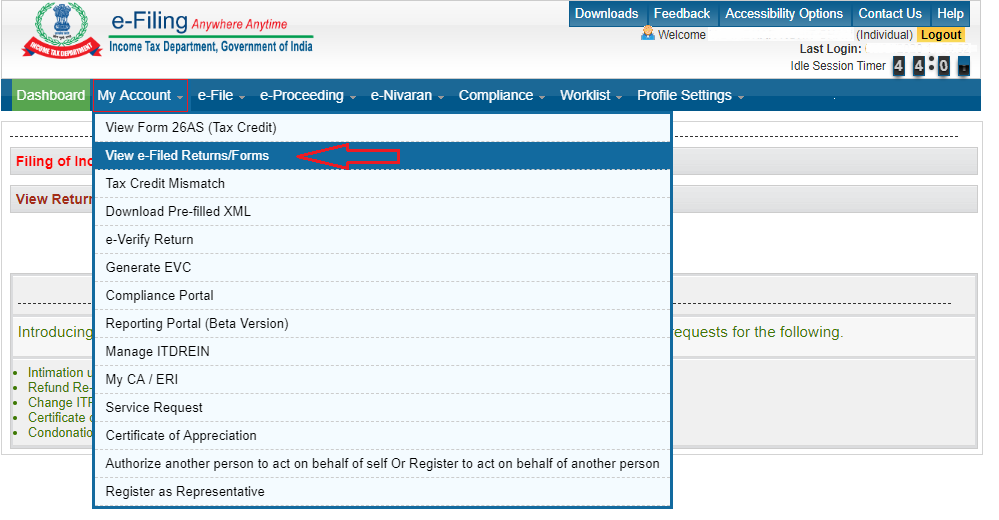

- Go to My Account from the top menu and select View e-Filed Returns/Forms from the drop-down.

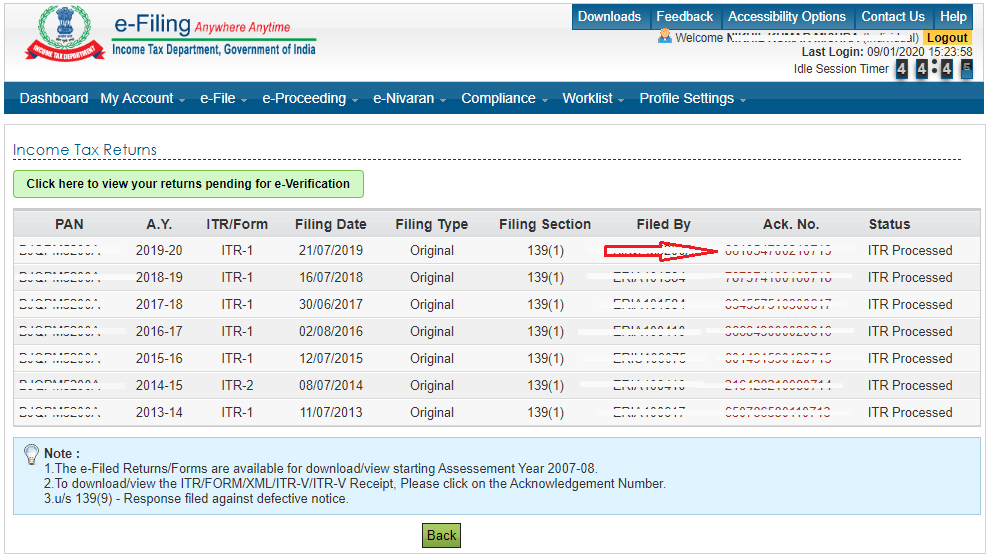

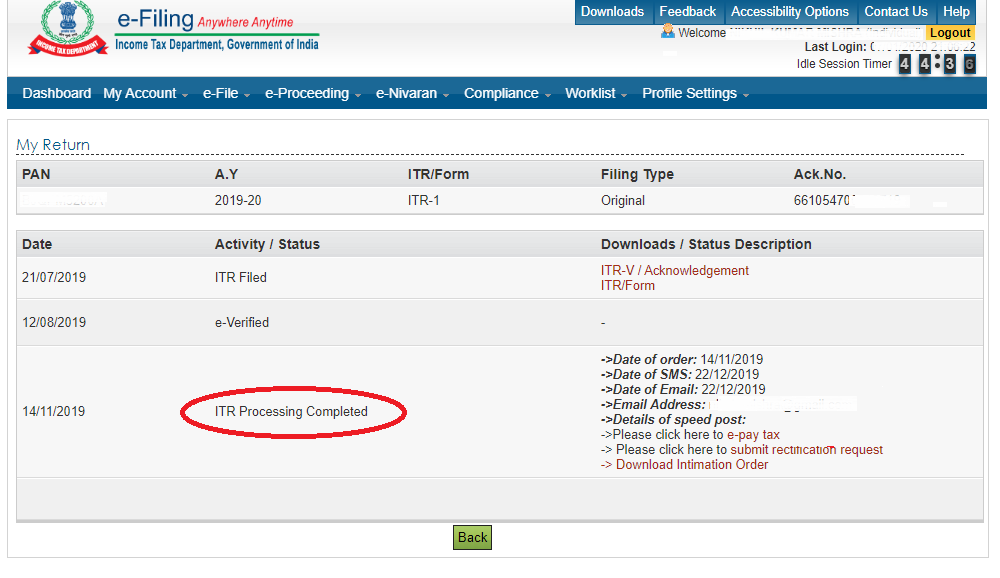

- Click on Ack. No. for the concerned Assessment Year:

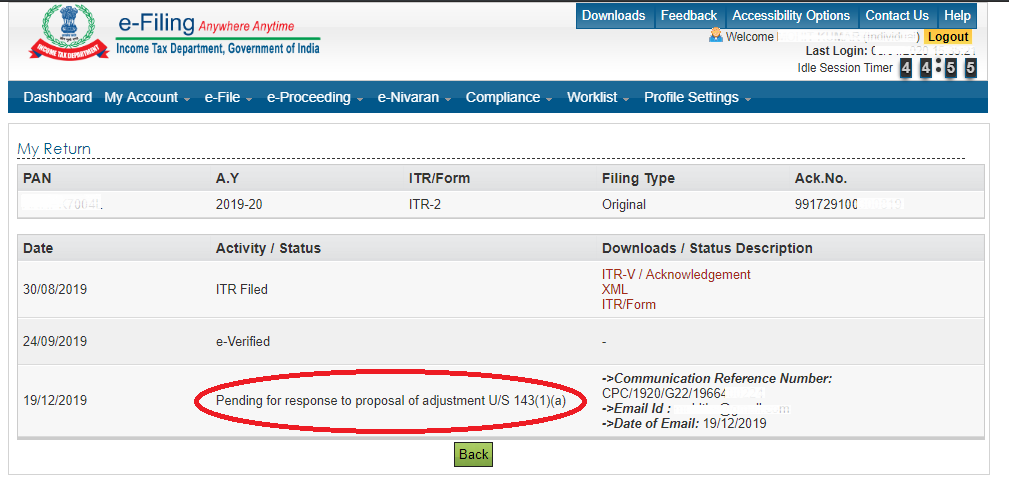

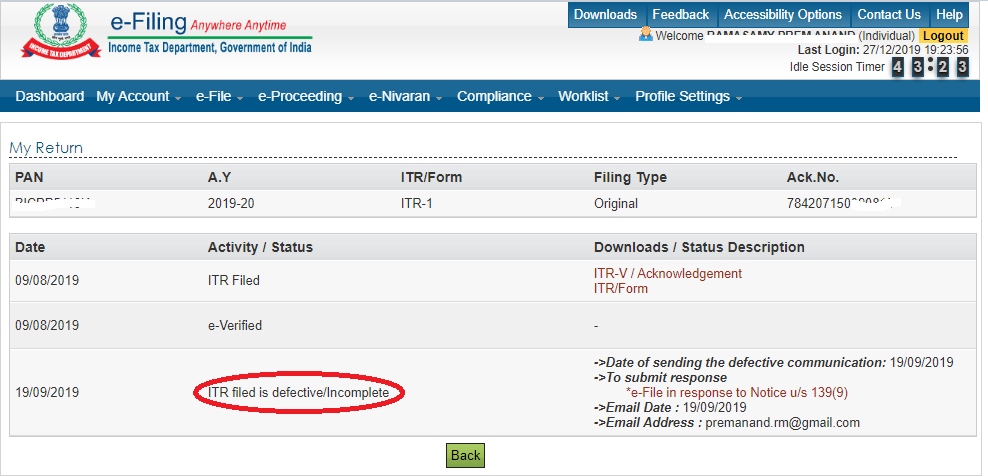

- If you have any of the following messages your return is subject to correction:

A. Pending for response to the proposal of adjustment U/S 143(1)(a):

B. ITR filed is defective/Incomplete:

C. ITR Processing completed and demand determined:

To get the notice copy please check your registered e-mail address (Inbox/ Spam). You might have received an e-mail with an attachment from DONOTREPLY@incometaxindiaefiling.gov.in or Call CPC at 1800-103-4455 and request for the same.

- To fetch notice from the Income-tax Department for any particular assessment year, you can also follow the below steps.

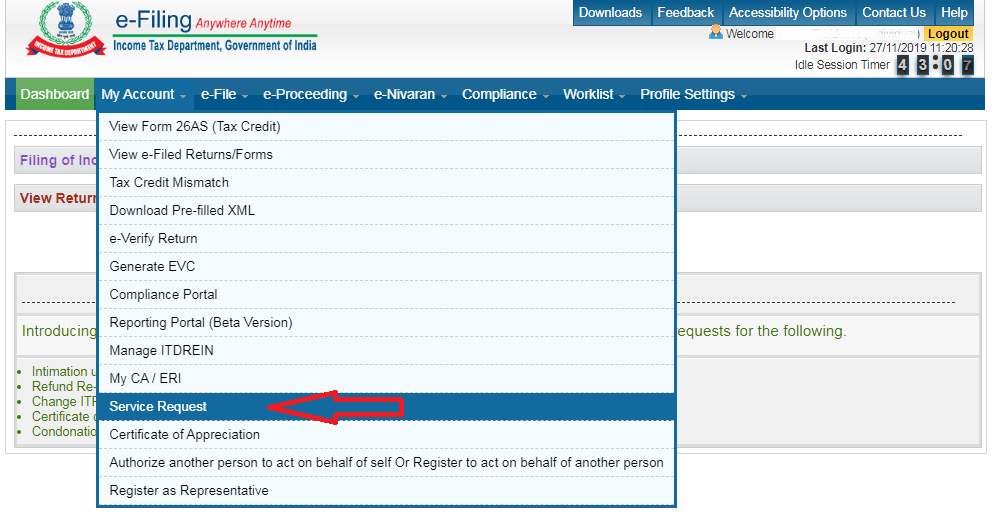

i. Click on my account >> service request

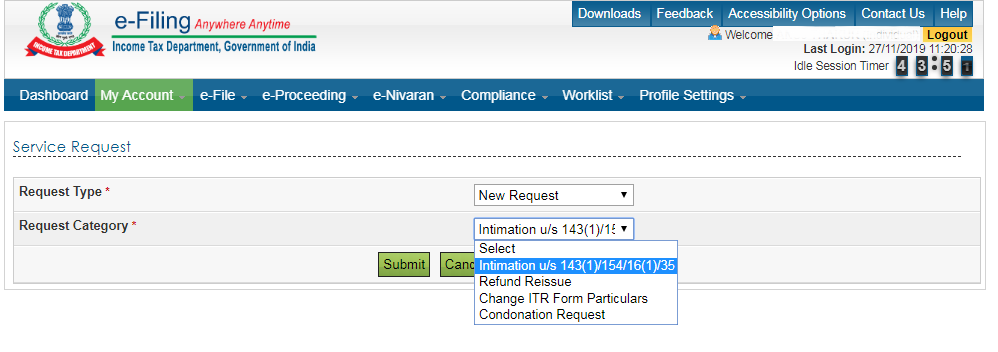

ii. Choose Request Type and Request category (Intimation u/s 143(1) ) to be selected on the resulting page.

Comments

0 comments

Please sign in to leave a comment.