It is very simple to verify whether you have any outstanding demand or have been issued any notice from the Income-tax department or not. In the first place, if you will have any outstanding demand, you will receive the intimation or notice from the Income-tax department on your registered email-id. But if for some reason, you have not received any outstanding demand e-mail from the Department or if you want to verify whether you have any such case with you or not, just follow the steps given below:

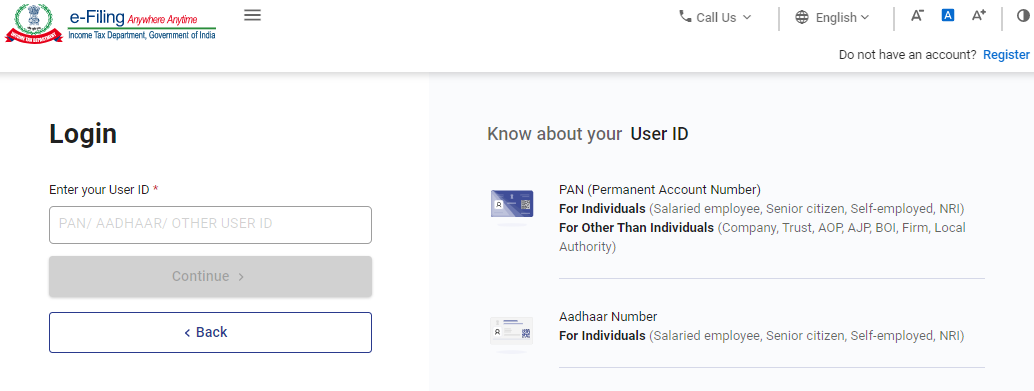

Step 1- Login to the Income-tax department’s website using your User ID (i.e your PAN) and password. If you don’t have an account already, you can register one from here itself.

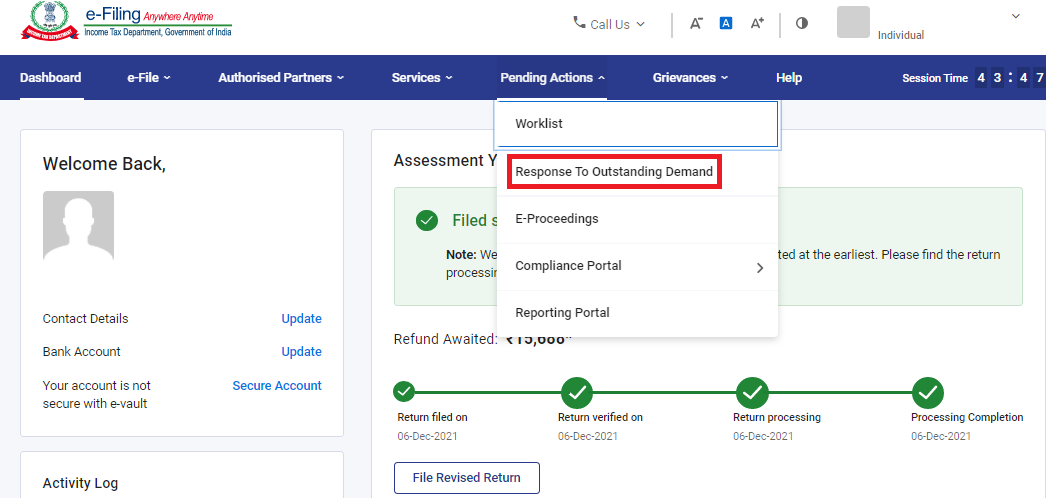

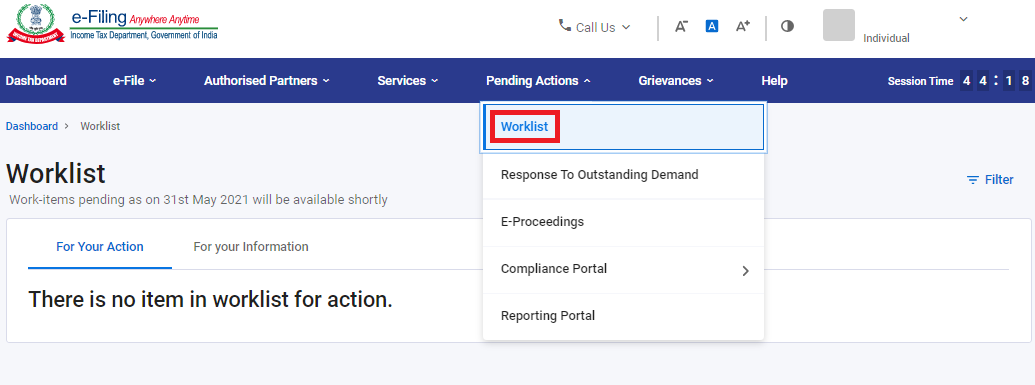

Step 2- Once logged in, click on the “Pending actions” tab and Select “Response To Outstanding Demand”. Refer to the screen given below:

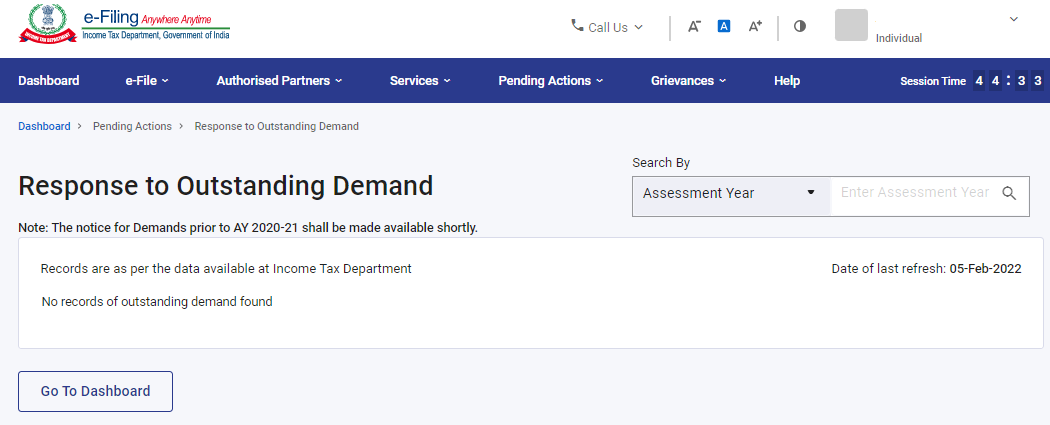

Step-3- If there is no pending action or outstanding demand showing, the following screen will be displayed

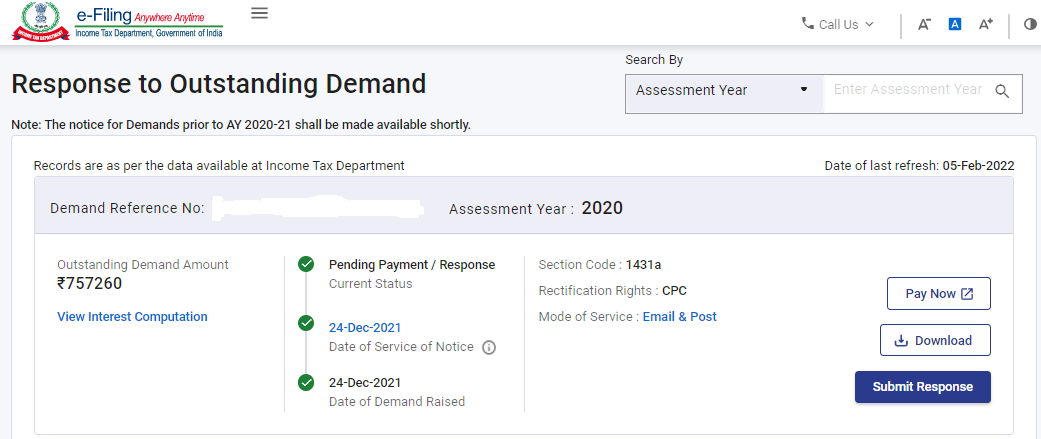

If there is any outstanding demand, a screen like the one given below will be displayed.

Also, to find if there is any notice pending against you, do the followings:-

Also, to find if there is any notice pending against you, do the followings:-

2. Select Worklist

If there are pending notices against you, They shall be listed there.

Comments

0 comments

Please sign in to leave a comment.