Form 26AS is an annual tax credit statement that gives the complete details of tax credited against your PAN. Form 26AS is a vital and hand-holding tool to which you can refer for your Income details and also for the taxes that are paid by you on such income and the tax deducted at source by the deductor such as employer, bank, etc. As a taxpayer, you can access or download Form 26AS from the Income-ax Department’s e-filing website.

Click here to know the steps to download Form 26AS.

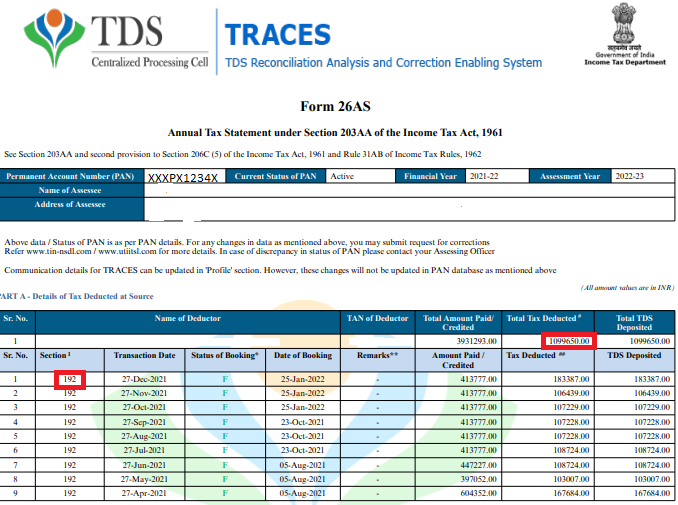

Once Form 26AS is downloaded you can see details of all the taxes deducted at the source in one document. Refer the below image

Comments

0 comments

Please sign in to leave a comment.